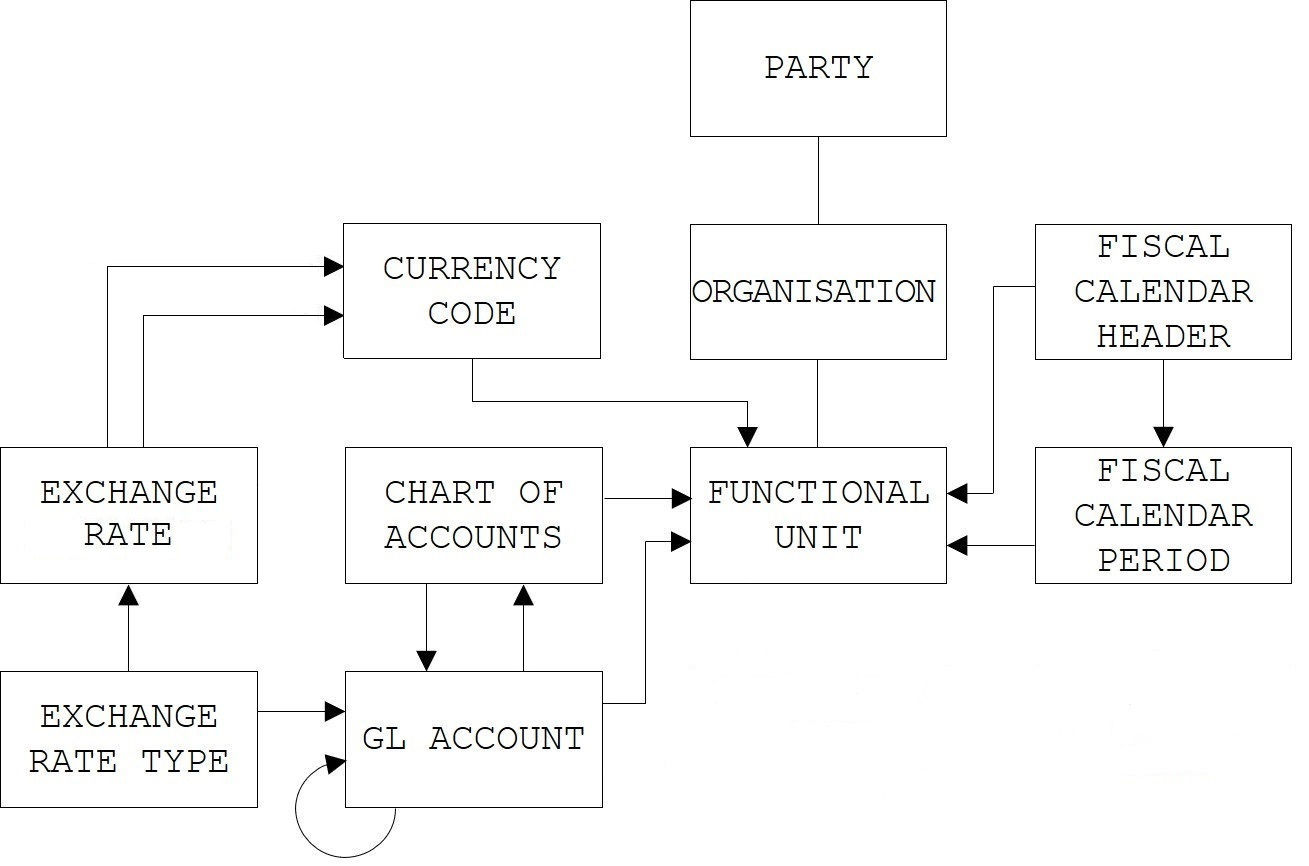

Figure 1 - Functional Unit, Chart of Accounts and Fiscal Calendar

28th September 2018

Amended: 30th March 2024

A general ledger represents the formal ledger for an organisation's financial statements with debit and credit account records validated by a trial balance. The ledger provides a complete record of financial transactions over the life of the organisation. It holds account information that is needed to prepare financial statements and includes accounts for assets, liabilities, owners' equity, revenues and expenses.

General ledgers are used by business entities and other organisations that employ the double-entry bookkeeping method, which means that each financial transaction affects at least two general ledger accounts and each entry has a debit and a credit transaction. Double-entry transactions are posted in two columns, with debit postings on the left and credit entries on the right, and the total of all debit and credit entries must balance.

The balance sheet includes cash and accounts receivable as assets in the balance sheet accounts. The accounting equation or balance sheet formula is stated as Assets - Liabilities = Equity.

After journal entry transactions are posted to the general ledger accounts, a trial balance report listing all the accounts and each account's balance is prepared at least once every year and reviewed by management. In addition, an accountant may perform an independent audit. These examinations may reveal the need to amend the trial balance by posting additional adjusting journal entries. The adjusted trial balance is used to prepare the organisation's financial statements.

The PARTY and ORGANISATION tables contain entries for every organisation which is required to be known to the GM-X application. At least one of these organisations is the "client" and it is the one for which the application is being run. This organisation is known as the "functional unit" and can be identified by adding it to the PARTY and ORGANISATION tables using a single party_id. This data provides the following:

It is also possible for a GM-X installation to handle the business for a group of organisations which do business under separate names, possibly using different functional currencies. Those organisations can be added as functional units to the PARTY and ORGANISATION tables. Each of them is identified in those tables by its own party_id.

The GM-X application can maintain separate general ledgers for these organisations. In this case each of those organisations must be added to the FUNCTIONAL_UNIT table using its party_id, in addition to the PARTY and ORGANISATION tables.

A chart of accounts (COA) is an accounting tool that provides a complete list of accounts in a general ledger. An account is a unique record for each type of asset, liability, equity, revenue and expense. The COA lists the identification codes, names and brief descriptions of accounts that an organisation has identified and made available for recording transactions in its general ledger. These establish the level of detail tracked in the general ledger.

A fiscal year (FY) is the time interval that an organisation uses for preparing annual budgets and financial statements. This interval may or may not coincide with a calendar year. The fiscal year may be divided into 12 calendar months ending on the last day of each month or may be divided into 12 periods of four or five weeks each comprising a 52- to 53-week fiscal year, where each period ends on the same day of the week.

The GM-X application allows charts of accounts, fiscal years and periods to be defined separately for each general ledger. Alternatively, when general ledgers are maintained for related functional units, it is often beneficial for each of the related Functional Units to adopt a standard chart of accounts and fiscal calendar. Standardisation makes it possible to compare and consolidate financial statements.

Figure 1 - Functional Unit, Chart of Accounts and Fiscal Calendar

This holds the identifier, name and description for each chart of accounts utilised by the various functional units for which a general ledger is maintained in the GM-X application.

It also identifies the accounts, which are held within the GL_ACCOUNT table, where currency translation gains or losses as well as rounding differences are posted when translating financial statements from functional to reporting currency.

Currency translation is the process of converting a foreign entity's functional currency financial statements to the reporting entity's financial statements. The foreign entity's financial statements in the functional currency should use the following exchange rates for translation:

Foreign currency translation gains and losses are a component of accumulated other comprehensive income.

| Field | Type | Description |

|---|---|---|

| chart_id | number | Identity number which is generated by the system. |

| chart_name | string | Short name. |

| chart_desc | string | Optional. Long description. |

| account_id_translation | string | Optional. This identifies the general ledger liability and equity, income or expense account affected by currency translation gains or losses (comprehensive income). Links to the GL_ACCOUNT table, and must have an account_type of 'LI' (liability and equity), 'IC' (income) or 'EX' (expense). Required if currency translation is performed. |

| account_id_trans_rounding | string | Optional. This identifies the general ledger liability and equity, income or expense account affected by currency translation rounding gains or losses. Links to the GL_ACCOUNT table, and must have an account_type of 'LI' (liability and equity), 'IC' (income) or 'EX' (expense). Required if currency translation is performed. |

This identifies the various types of exchange rates utilised when translating an entity's results from functional currency to reporting currency.

| Field | Type | Description |

|---|---|---|

| exchange_rate_type_id | string | Unique identity. |

| exchange_rate_type_name | string | Short name. |

| exchange_rate_type_desc | string | Optional. Long description. |

| exchange_rate_usage | string | This identifies the usage of this exchange rate type for currency translation purposes. Allowable values are:

|

Here are some examples:

| Id | Description | Usage |

|---|---|---|

| AVERAGE | Weighted average | AVG |

| MONTHEND | Month end | END |

| HST1 | Historical paid in capital | HST |

| HST2 | Historical factory acquisition | HST |

This holds the exchange rates between functional and reporting currencies that are utilised for currency translation processing.

| Field | Type | Description |

|---|---|---|

| currency_from | string | This identifies the functional currency. Links to the CURRENCY_CODE table. |

| currency_to | string | This identifies the reporting currency. Links to the CURRENCY_CODE table. |

| exchange_rate_type_id | string | This identifies the exchange rate type. Links to the EXCHANGE_RATE_TYPE table. |

| seq_no | number | A unique number which is assigned by the system. Each pair of currencies will have its own numbering sequence, starting at 1. |

| exchange_rate | number | This is the rate which, when divided by an amount denominated in functional currency, yields an amount denominated in reporting currency. |

| start_date | date | This is the earliest date when the exchange rate first became, or will become, effective. |

| end_date | date | This is the latest date when the exchange rate was, or will be, effective. Blank signifies an unspecified date in the future. |

This holds the list of accounts for each chart of accounts.

Accounts may be grouped on financial statements. For example when each bank account has its own general ledger account, those accounts can be grouped into a 'cash in banks' category which, together with petty cash, cash in banks, funds in transit, marketable securities, commercial paper, Treasury bills and short-term government bonds can be further grouped into the 'cash and cash equivalents' ('CCE') category. In this case there will be two categories, one called 'cash and cash equivalents' and another called 'cash in banks'. By defining the 'cash and cash equivalents' category as the parent of the 'cash in banks' category you are creating a hierarchy of categories. When you create a general ledger account representing a specific bank account you should identify 'cash in banks' as its parent. In this relationship 'cash in banks' is called the senior or parent and each bank account is called the junior or child. You may create categories of your choosing and define hierarchies of your choosing. The categories are known as 'summary accounts' and may contain other summary accounts as well as detail accounts.

If you have defined a hierarchy then you can only post to detail accounts at the bottom of the hierarchy. Using the example above you may post financial transactions to any of the general ledger accounts representing specific bank accounts, but not to the 'cash in banks' or 'cash and cash equivalents' accounts for which only subtotals or totals are displayed on financial statements.

Account numbers often have multiple dimensions which allow assets, liabilities, equity, revenue and expense transactions to be tracked from different perspectives or identifiers within the general ledger. For example they may contain a four-digit account number, three-digit division code and two-digit department code separated by a delimiter. In this case the account number '100104110' can be formatted like '100.10.4110'. When formatted account numbers are specified, to save data entry time the GM-X application allows either formatted or unformatted account numbers to be entered.

| Field | Type | Description |

|---|---|---|

| chart_id | number | This identifies the chart of accounts. Links to an entry on the CHART_OF_ACCOUNTS table. |

| account_id | string | Account number which is defined manually. |

| account_id_formatted | string | The formatted account number. The default formatted account number is the same as the account_id. Formatting characters which can be inserted into the account_id as separators are '.' (dot), '-' (hyphen) or ' ' (space). |

| account_name | string | Short name. |

| account_desc | string | Optional. Long description. |

| account_type | string | This identifies how the account affects the trial balance. Allowable values are:

|

| account_id_snr | string | Optional. This identifies the account number in which this account number is grouped for reporting purposes. Links to an entry on the GL_ACCOUNT table, and must have the same account type as this account. |

| is_posting_allowed | boolean | A YES/NO switch with an initial value of YES. It indicates if journal entries can be posted to this account or not. If this account is a grouping of other account numbers then the initial value is NO and cannot be changed. |

| exchange_rate_type_id | string | Optional. This identifies the month-end or historical exchange rate type to be utilised when translating balances for this account from functional to reporting currency. Links to an entry on the EXCHANGE_RATE_TYPE table. Required only for 'AS' (asset) and 'LI' (liabilities and equity) accounts if currency translation is performed. |

| is_elimination_account | boolean | A YES/NO switch with an initial value of NO. If YES, it denotes an intercompany asset, liability, income or expense account having balances which must be eliminated when preparing consolidated financial statements. |

| uom_id_statistic | string | Optional. The unit of measure for the statistical balances accumulated in the GL_ACCOUNT_OPENING_BALANCE and GL_ACCOUNT_PERIOD_BALANCE tables. Links to an entry on the UNIT_OF_MEASURE table. |

This holds information about each fiscal calendar system, including settings which determine the beginning and ending dates for fiscal years and periods at any time in the past or future.

| Field | Type | Description |

|---|---|---|

| fiscal_calendar_id | number | Identity number which is generated by the system. |

| fiscal_calendar_name | string | Short name. |

| fiscal_calendar_desc | string | Optional. Long description. |

| fiscal_calendar_type | string | This identifies how the fiscal periods for this calendar are set up. Allowable values are:

|

| fiscal_year_end_month | number | Optional. Only required if fiscal_calendar_type is 'FY' (fiscal year) or is 'FW' (fiscal week). Identifies the month when each fiscal year ends. Allowable values are 1 (January) through to 12 (December). |

| ending_day_of_week | number | Optional. Only required if fiscal_calendar_type is 'FW' (fiscal weeks). Identifies the day of the week when each fiscal period always ends. Allowable values are 1 (for Monday) through 7 (for Sunday) which is the ISO-8610 standard numeric representation of the day of the week. |

| end_date_method | string | Optional. Only required if fiscal_calendar_type is 'FW' (fiscal weeks). Identifies the method for determining the ending date of each fiscal year, when each fiscal period always ends on the same day of the week. Allowable values are:

|

| end_date_periods | number | Optional. Only required if fiscal_calendar_type is 'FW' (fiscal weeks). Identifies the method for determining the ending date of each fiscal period, when each fiscal period always ends on the same day of the week. Allowable values are:

|

This identifies every fiscal period with each fiscal year within a particular fiscal calendar.

| Field | Type | Description |

|---|---|---|

| fiscal_calendar_id | number | This identifies the fiscal calendar. Links to an entry on the FISCAL_CALENDAR_HEADER table. |

| fiscal_year | number | The Gregorian year when the end of the fiscal year occurs. Allowable values are 1 through 9999. |

| fiscal_period | number | The identity of the fiscal period. Allowable values are 1 through 13. Periods 1 through 12 correspond to months of the fiscal year. Period 13 is the audit period. |

| start_date | date | The start date for this fiscal period. For periods 1 and 13, this must be the first day following the ending date of the previous fiscal year (if any). For periods 2 through 12, this must be the first day following the ending date of the previous fiscal period. |

| end_date | date | The end date for this fiscal period. For periods 1 through 12, this is determined by the fiscal calendar type, ending day of the week (if applicable), method for determining the ending date of each fiscal year (if applicable) and method for determining the ending date of each fiscal period (if applicable) for the FISCAL_CALENDAR_HEADER to which this period is linked. For period 13, this is the last day of the fiscal year determined by the fiscal calendar type, ending day of the week (if applicable) and method for determining the ending date of each fiscal year (if applicable). |

This holds the identifier, reporting currency, chart of accounts, fiscal calendar and last closed fiscal period for each general ledger maintained within the GM-X application. It also identifies various accounts that the GM-X application utilises by default or to automate specific accounting functions.

Each of the organisations for which a general ledger is kept is also known as a Business Entity.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the ORGANISATION table. |

| currency_code_reporting | string | Optional. Links to an entry on the CURRENCY_CODE table. Only required if financial reports need to be produced in a currency that is different from the currency in which the organisation operates. |

| chart_id | number | This identifies the chart of accounts. Links to an entry on the CHART_OF_ACCOUNTS table. Cannot be changed if any entries for this organisation exist in the FUNC_UNIT_PRICE_COMPONENT, GL_ACCOUNT_OPENING_BALANCE, GL_ACCOUNT_PERIOD_BALANCE, JOURNAL_ENTRY_ITEM, RECURRING_JE_ITEM or STANDING_JE_ITEM tables. |

| fiscal_calendar_id | number | This identifies the fiscal calendar used by this Business Entity. Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| last_closed_fiscal_period_year | number | Optional. This is the organisation's last closed fiscal year (if any). Required if two or more of the organisation's fiscal years have been closed using this GM-X system. If this is the case, only two years can be chosen: the current last_closed_fiscal_period_year, and the year preceding it. Selecting the earlier of those two years will automatically re-open the last closed fiscal year. But if only one fiscal year has been closed, that year and a blank year can be chosen. Selecting the blank year will automatically re-open the earliest fiscal year during which any journal entries have been posted to this organisation's general ledger.

Re-opening any of these fiscal years will automatically re-open the audit period for that year and reset the last_closed_fiscal_period to 12 (the last regular fiscal period). Links to 13 related entries on the FISCAL_CALENDAR_PERIOD table. |

| last_closed_fiscal_period | number | Optional. This is the month number of the last closed regular fiscal period of the current fiscal year (if any). If it is blank, then none of the current fiscal year's regular fiscal periods have been closed yet. The current fiscal year is the year following the last_closed_fiscal_period_year. If the last_closed_fiscal_period_year is blank (i.e. the organisation has never closed a fiscal year on this system yet), the current fiscal year is the earliest fiscal year during which any journal entries have been posted to this organisation's general ledger.

Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| is_audit_period_closed | boolean | A YES/NO switch with an initial value of NO. It indicates if the audit period for the current fiscal year is closed, or not. The value cannot be changed to YES until the last_closed_fiscal_period is 12 (i.e. the last period of the current fiscal year is closed). Changing the value to YES will automatically close the current fiscal year by changing the last_closed_fiscal_period_year to the current fiscal year, and resetting the last_closed_fiscal_period to blank. |

| account_id_cash_in_bank | string | This identifies the general ledger asset account affected by deposits to, or withdrawals from, the bank account(s) into which cash received from customers is deposited and from which cash paid to vendors is withdrawn by this organisation. Links to an entry on the GL_ACCOUNT table. |

| account_id_trade_receivables | string | This identifies the default general ledger asset account account in which open trade receivables belonging to this organisation are held. Links to an entry on the GL_ACCOUNT table. |

| account_id_vendor_deposit | string | Optional. This identifies the general ledger asset account affected by this organisation's accrual of vendor deposits. Links to an entry on the GL_ACCOUNT table. Required if the organisation pre-pays expenses to vendors. |

| account_id_ffe | string | Optional. This identifies the general ledger asset account in which the acquisition value of depreciable property belonging to this organisation is held. Links to an entry on the GL_ACCOUNT table. Required for capitalising fixed assets belonging to this organisation. |

| account_id_accum_depreciation | string | Optional. This identifies the general ledger asset account in which the accumulated depreciation of depreciable property belonging to this organisation is held. Links to an entry on the GL_ACCOUNT table. Required for depreciating fixed assets belonging to this organisation. |

| account_id_inventory | string | Optional. This identifies the default general ledger asset account in which the value of inventory belonging to this organisation is held. Links to an entry on the GL_ACCOUNT table. Required if the organisation holds any inventories. |

| account_id_wip | string | This identifies the default general ledger asset account in which the value of unbilled work-in-process (WIP) belonging to this organisation is held. Links to an entry on the GL_ACCOUNT table. |

| account_id_trade_payables | string | This identifies the default general ledger liability account in which open trade payables owed by this organisation are held. Links to an entry on the GL_ACCOUNT table. |

| account_id_sales_tax_payable | string | Optional. This identifies the default general ledger liability account in which sales or value-added taxes owed to tax authorities by this organisation are held. Links to an entry on the GL_ACCOUNT table. Required if the organisation collects sales or value-added taxes from customers. |

| account_id_tax_wh_payable | string | Optional. This identifies the default general ledger liability account in which withheld corporate or personal income taxes payable to a tax authority are held. Links to an entry on the GL_ACCOUNT table. Required if supplier payments made by the organisation are subject to corporate or personal income tax withholding (tax deducted at source). |

| account_id_customer_deposit | string | Optional. This identifies the general ledger liability account affected by this organisation's accrual of customer deposits. Links to an entry on the GL_ACCOUNT table. Required if the organisation invoices and accepts customer deposits. |

| account_id_commission_payable | string | Optional. This identifies the default general ledger liability account affected by sales commissions payable. Links to an entry on the GL_ACCOUNT table. Required if the organisation pays commissions on sales. |

| account_id_pension_payable | string | Optional. This identifies the general ledger liability account affected by pensions payable. Links to an entry on the GL_ACCOUNT table. Required if the organisation withholds pension contributions from employee pay, or matches employee pension contributions. |

| account_id_commission_liability | string | Optional. This identifies the default general ledger liability account affected by this organisation's accrual of sales commission liabilities. Links to an entry on the GL_ACCOUNT table. Required if the organisation pays commissions on sales. |

| account_id_sales_tax_liability | string | Optional. This identifies the default general ledger liability account affected by this organisation's accrual of sales or value added taxes collected from customers and paid to tax authorities. Links to an entry on the GL_ACCOUNT table. Required if the organisation collects sales or value added taxes from customers. |

| account_id_accrued_expense | string | This identifies the general ledger liability account in which accrued trade payables owed by this organisation but not yet invoiced by suppliers are held. Links to an entry on the GL_ACCOUNT table. |

| account_id_retained_earnings | string | This identifies the general ledger equity account affected by the year-end close and rollover of net income or (loss) to the following fiscal year. Links to an entry on the GL_ACCOUNT table. |

| account_id_sales_supply | string | Optional. This identifies the default general ledger income account affected by the accrual of revenue derived from goods supplied by this organisation to customers. Links to an entry on the GL_ACCOUNT table. Required if the organisation derives revenues from the supply of goods to customers. |

| account_id_sales_use | string | Optional. This identifies the default general ledger income account affected by the accrual of revenue derived from customer use (rental, lease or licensure) of property belonging to this organisation. Links to an entry on the GL_ACCOUNT table. Required if the organisation derives revenues from customer use of the organisation's property. |

| account_id_sales_service | string | Optional. This identifies the default general ledger income account affected by the accrual of revenue derived from services supplied by this organisation to customers. Links to an entry on the GL_ACCOUNT table. Required if the organisation derives revenues from the supply of services to customers. |

| account_id_exp_recovery | string | Optional. This identifies the default general ledger income account affected by the accrual of revenue derived by this organisation from recovery of nontax expenses from customers. Links to an entry on the GL_ACCOUNT table. Required if the organisation derives revenues from customer expense reimbursements. |

| account_id_tax_recovery | string | Optional. This identifies the default general ledger income account affected by the accrual of revenue derived by this organisation from recovery of sales, use and output value-added taxes from customers. Links to an entry on the GL_ACCOUNT table. Required if the organisation can pass through sales, use or output VAT to its customers. |

| account_id_cogs | string | Optional. This identifies the default general ledger income or expense account affected by the direct cost of goods sold to this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required if the organisation derives revenues from the supply of goods to customers. |

| account_id_ppv | string | Optional. This identifies the default general ledger income or expense account affected by purchase price variances. Links to an entry on the GL_ACCOUNT table. Required if the organisation values inventories and cost of goods sold at standard or frozen standard cost. |

| party_id_commission | number | Optional. This identifies the default party (person or organisation) which earns sales commissions. Links to an entry on the PARTY table. Required if the system will calculate sales commissions or bonuses automatically. |

| commission_percent | number | Optional. This is the default sales commission percentage. Required if the system will calculate sales commissions or bonuses automatically. |

| account_id_commission_expense | string | Optional. This identifies the default general ledger income or expense account affected by this organisation's accrual of sales commission expenses. Links to an entry on the GL_ACCOUNT table. Required if the organisation pays commissions on sales. |

| account_id_direct_labour | string | Optional. This identifies the default general ledger income or expense account affected by the direct cost of labour required to provide services to this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required if the organisation derives revenues from the supply of services to customers. |

| account_id_staff_direct_reimb | string | Optional. This identifies the default general ledger income or expense account affected by the accrual of nontax expenses incurred by the organisation that are recoverable from this organisation's customers and reimbursable to this organisation's direct staff. Links to an entry on the GL_ACCOUNT table. Required when this organisation's direct staff may claim expenses that are recoverable from this organisation's customers. |

| account_id_staff_direct_mileage | string | Optional. This identifies the general ledger income or expense account affected by the accrual of mileage expenses incurred by the organisation that are reimbursable to this organisation's direct staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's direct staff may claim out-of-pocket expenses for business use of their personal automobiles. |

| account_id_staff_direct_air | string | Optional. This identifies the general ledger income or expense account affected by the accrual of air transportation expenses incurred by the organisation that are reimbursable to this organisation's direct staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's direct staff may claim air transportation expenses. |

| account_id_staff_direct_hotel | string | Optional. This identifies the general ledger income or expense account affected by the accrual of accommodation expenses incurred by the organisation that are reimbursable to this organisation's direct staff but are not recoverable from this organisation's customers. Links to the GL_ACCOUNT table. Required when this organisation's direct staff may claim accommodation expenses. |

| account_id_staff_direct_meal_own | string | Optional. This identifies the general ledger income or expense account affected by the accrual of meal and incidental expenses incurred by the organisation that are reimbursable to this organisation's direct staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's direct staff may claim meal and incidental expenses on either a per-diem or actual cost basis. |

| account_id_staff_direct_entertain | string | Optional. This identifies the general ledger income or expense account affected by the accrual of entertainment expenses incurred by the organisation that are reimbursable to this organisation's direct staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's direct staff may claim entertainment expenses. |

| account_id_staff_direct_other | string | Optional. This identifies the general ledger income or expense account affected by the accrual of other expenses incurred by the organisation that are reimbursable to this organisation's direct staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's direct staff may claim such expenses. |

| pension_percent | number | Optional. This is the percentage of gross employee compensation to be withheld as the employee's pension contribution, or matched by the employer. Required if the organisation withholds pension contributions from employee pay, or matches employee pension contributions. |

| account_id_pension_expense | string | Optional. This identifies the general ledger expense account affected by this organisation's employee pension contributions. Links to an entry on the GL_ACCOUNT table. Required if the organisation matches employee pension contributions. |

| account_id_staff_indirect_reimb | string | Optional. This identifies the default general ledger income or expense account affected by the accrual of nontax expenses incurred by the organisation that are recoverable from this organisation's customers and reimbursable to this organisation's management or indirect staff. Links to an entry on the GL_ACCOUNT table. Required when this organisation's management or indirect staff may claim expenses that are recoverable from this organisation's customers. |

| account_id_staff_indirect_mileage | string | Optional. This identifies the general ledger expense account affected by the accrual of mileage expenses incurred by the organisation that are reimbursable to this organisation's management or indirect staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's management or indirect staff may claim out-of-pocket expenses for business use of their personal automobiles. |

| account_id_staff_indirect_air | string | Optional. This identifies the general ledger expense account affected by the accrual of air transportation expenses incurred by the organisation that are reimbursable to this organisation's management or indirect staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's management or indirect staff may claim air transportation expenses. |

| account_id_staff_indirect_hotel | string | Optional. This identifies the general ledger expense account affected by the accrual of accommodation expenses incurred by the organisation that are reimbursable to this organisation's management or indirect staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's management or indirect staff may claim accommodation expenses. |

| account_id_staff_indirect_meal_own | string | Optional. This identifies the general ledger expense account affected by the accrual of meal and incidental expenses incurred by the organisation that are reimbursable to this organisation's management or indirect staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's management or indirect staff may claim meal and incidental expenses on either a per-diem or actual cost basis. |

| account_id_staff_indirect_entertain | string | Optional. This identifies the general ledger expense account affected by the accrual of entertainment expenses incurred by the organisation that are reimbursable to this organisation's management or indirect staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's management or indirect staff may claim entertainment expenses. |

| account_id_staff_indirect_other | string | Optional. This identifies the general ledger expense account affected by the accrual of other expenses incurred by the organisation that are reimbursable to this organisation's management or indirect staff but are not recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required when this organisation's management or indirect staff may claim such expenses. |

| account_id_depreciation | string | Optional. This identifies the general ledger expense account affected by the accrual of depreciation expense for depreciable property belonging to this organisation. Links to an entry on the GL_ACCOUNT table. Required for depreciating fixed assets belonging to this organisation. |

| account_id_debtor_fin_dsc_offered | string | This identifies the default general ledger income or expense account in which debtor financial discounts offered are accumulated. Links to an entry on the GL_ACCOUNT table. |

| account_id_creditor_fin_dsc_taken | string | This identifies the default general ledger income or expense account in which creditor financial discounts taken are accumulated. Links to an entry on the GL_ACCOUNT table. |

| account_id_book_gain_loss | string | Optional. This identifies the general ledger income or expense account affected by revaluation of open accounts receivable and payable denominated in a currency other than the organisation's functional currency. Links to an entry on the GL_ACCOUNT table. Required for revaluation processing of open accounts receivable and payable. |

| account_id_crystallised_gain_loss | string | Optional. This identifies the general ledger income or expense account affected by settlement of open accounts receivable and payable denominated in a currency other than the organisation's functional currency. Links to an entry on the GL_ACCOUNT table. Required when customer and vendor invoices may be denominated and settled in a currency other than the organisation's functional currency. |

| account_id_tax_reimb | string | Optional. This identifies the default general ledger income or expense account affected by the accrual of taxation expenses incurred by the organisation that are recoverable from this organisation's customers. Links to an entry on the GL_ACCOUNT table. Required if the organisation can pass through sales, use or output VAT to its customers. |

| account_id_tax_wh_prepaid | string | Optional. This identifies the default general ledger asset account in which withheld corporate or personal income taxes belonging to this organisation are held. Links to an entry on the GL_ACCOUNT table. Required if customer payments made to the organisation are subject to corporate or personal income tax withholding (tax deducted at source) and the amount deducted is not a final tax assessment. |

| account_id_tax_wh_final | string | Optional. This identifies the default general ledger expense account affected by final withholding tax. Links to an entry on the GL_ACCOUNT table. Required if customer payments made to the organisation are subject to corporate or personal income tax withholding (tax deducted at source) and the amount deducted is a final tax assessment. |

| account_id_commissions_fees | string | Optional. This identifies the general ledger expense account affected by financial intermediary charges such as currency exchange fees, bank service fees and collection agency fees. Links to an entry on the GL_ACCOUNT table. Required if financial intermediaries can collect those fees by automatically debiting the organisation's financial accounts upon receipt or disbursement of funds, and an appropriate expense account having account_usage = 'commissions_fees' is not specified for each SUBSYSTEM_JE_TEMPLATE_HEADER entry which is utilised for such receipts or disbursements. |

| account_id_auc | string | Optional. This identifies the general ledger asset account to be debited when value is added to an asset under construction (AUC) belonging to this general asset account. Links to an entry on the GL_ACCOUNT table. |

| account_id_expense | string | Optional. This identifies the general ledger expense account to be debited when an asset belonging to this general asset account is expensed instead of depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_impairment | string | Optional. This identifies the general ledger expense account to be debited when an asset belonging to this general asset account is impaired. Links to an entry on the GL_ACCOUNT table. |

| account_id_disposal | string | Optional. This identifies the general ledger income or expense account to be credited when an asset belonging to this general asset account is disposed of. Links to an entry on the GL_ACCOUNT table. |

| account_id_reserve | string | Optional. This identifies the default general ledger asset account affected by yield loss variances and/or inventory item variances. Links to an entry on the GL_ACCOUNT table. Required if the organisation accounts for inventory reserves arising from yield loss variances and/or inventory item variances separately from the inventory account. |

| account_id_ylv | string | Optional. This identifies the default general ledger income or expense account affected by yield loss variances. Links to an entry on the GL_ACCOUNT table. Required if the organisation records conversions. |

| account_id_variance | string | Optional. This identifies the default general ledger income or expense account affected by inventory item variances. Links to an entry on the GL_ACCOUNT table. Required if the organisation records inventory item variances arising from stock checks or other reasons. |

A journal entry ('JE'), sometimes called a 'journal voucher', is a transaction that is recorded in a functional unit's general journal and consists of the following:

Following the double-entry accounting method, if the journal entry affects at least two accounts, and the amounts to be debited and credited balance, these journalised amounts (which will appear in the journal in order by date) are then posted to the accounts in the general ledger.

Each journal entry has at least two states, pending and posted. After a journal entry is posted, its amounts and accounts must not be changed. Instead, if corrections are needed, two new journal entries should be entered and posted, one to reverse the original journal entry and the other consisting of the corrected amounts and accounts.

It is also possible for journal entries to have additional states. For example, journal entries may require approval before they are posted.

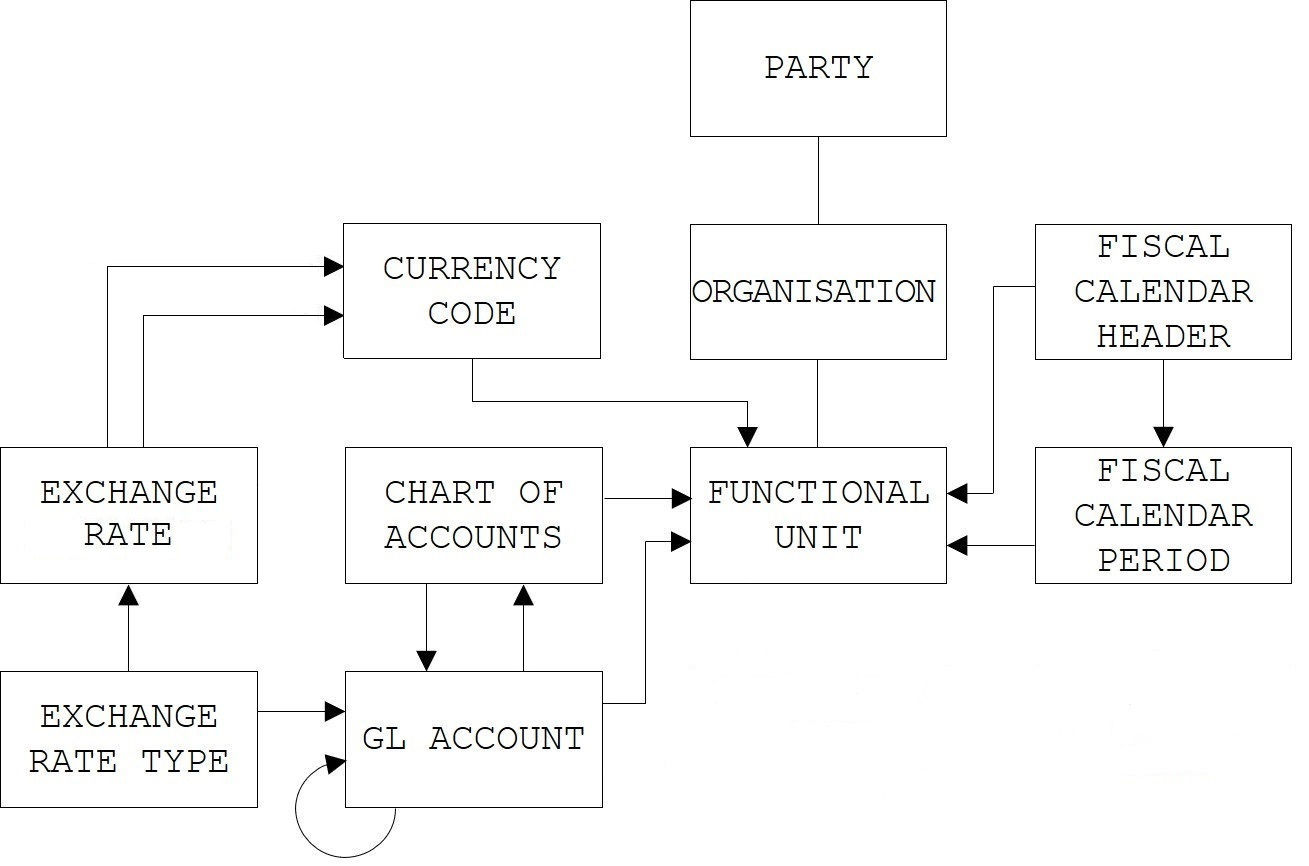

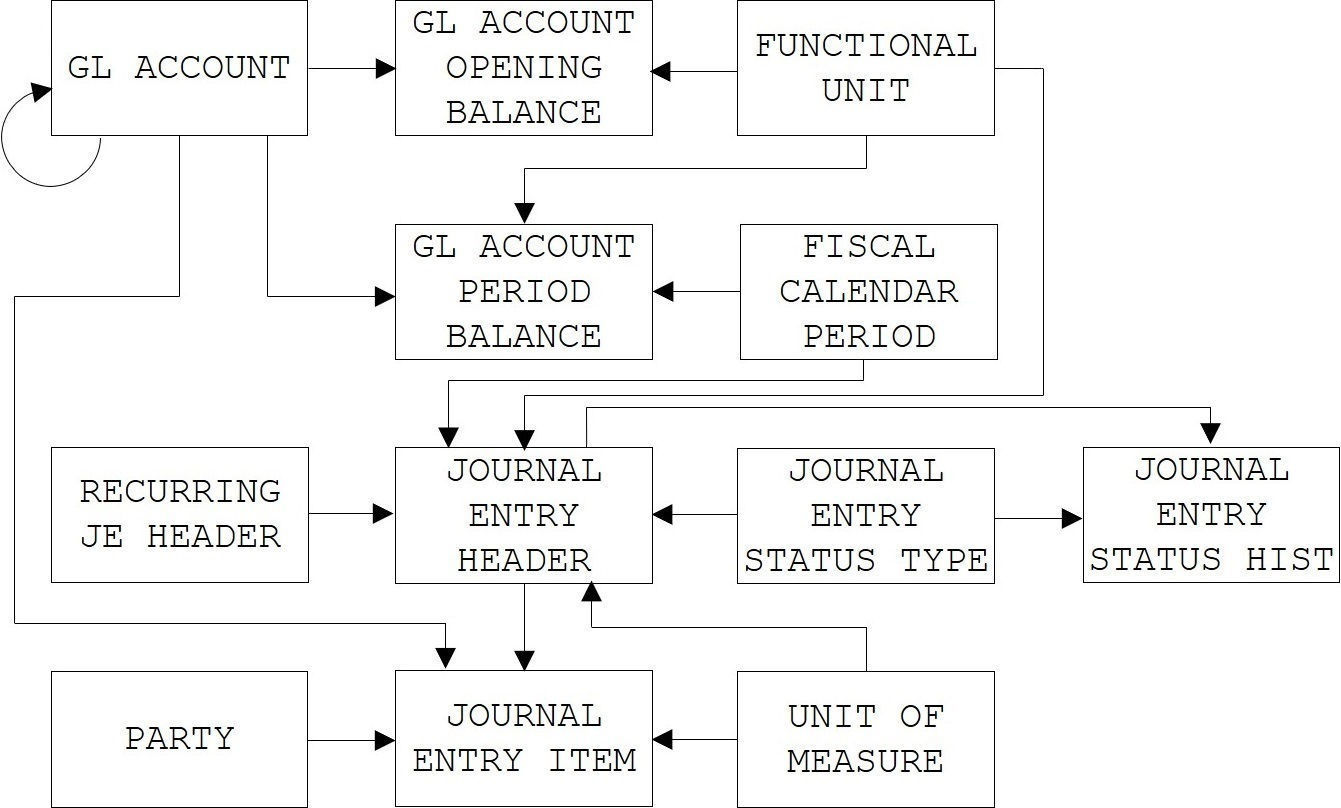

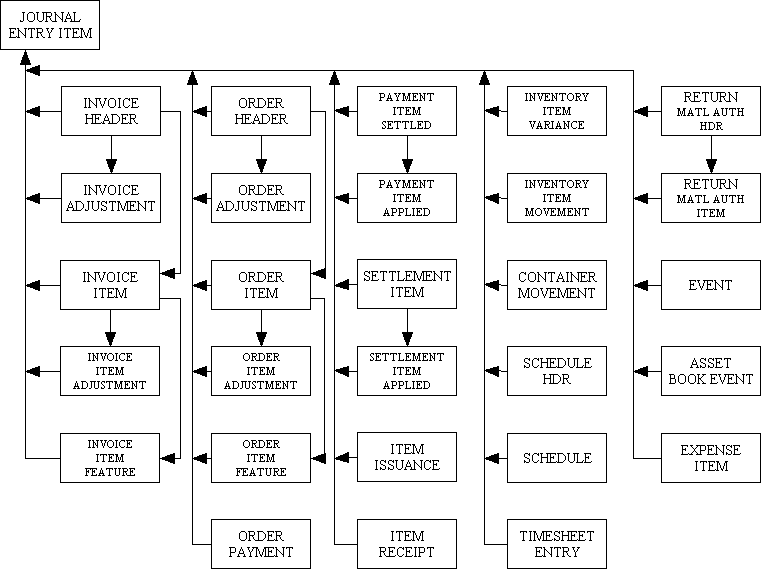

Figure 2a - Opening Balances, Journal Entries and Period Balances

Figure 2b - Relationships with other database tables

This holds the opening balances and budgets for each functional unit and account. Opening balances reflect the effects of journal entries that were already posted before the GM-X application was placed into service. This means that organisations which commenced operations after the GM-X application was placed into service will not have any opening balances.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the FUNCTIONAL_UNIT table. |

| chart_id | string | This identifies the chart of accounts. Links to an entry on the GL_ACCOUNT table. |

| account_id | string | This identifies the general ledger account. Links to an entry on the GL_ACCOUNT table. |

| debit_functional | number | Optional. The opening debit balance in the functional currency. Never negative. |

| credit_functional | number | Optional. The opening credit balance in the functional currency. Never negative. |

| debit_reporting | number | Optional. The system calculates this value during currency translation processing when the debit_functional value is greater than the credit_functional value for this organisation and account. In this case it is the opening balance in the reporting currency. Blank if currency translation is not performed. Always blank for 'IC' (income) and 'EX' (expense) accounts. |

| credit_reporting | number | Optional. The system calculates this value during currency translation processing when the credit_functional value is greater than the debit_functional value for this organisation and account. In this case it is the opening balance in the reporting currency. Blank if currency translation is not performed. Always blank for 'IC' (income) and 'EX' (expense) accounts. |

| debit_budget | number | Optional. The opening debit budget in functional currency. Never negative. |

| credit_budget | number | Optional. The opening credit budget in functional currency. Never negative. |

| statistic | number | Optional. The sum of all statistics posted to this organisation, account and fiscal period, in the unit of measure specified for the account_id. May be positive or negative. |

This holds information about journal entries.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the FUNCTIONAL_UNIT table. |

| fiscal_calendar_id | number | This identifies the fiscal calendar. Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| fiscal_year | number | This identifies the Gregorian year when the end of the fiscal year occurs. Automatically calculated by the system based on the posting_date. Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| fiscal_period | number | This identifies the fiscal period. Automatically calculated by the system based on the posting_date. Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| journal_number | number | This is the journal entry number which is generated by the system. Each functional unit and fiscal year will have its own numbering sequence. |

| posting_date | date | This is the date which determines the fiscal period to which this journal entry was (or will be) posted. Today's date by default. |

| transaction_date | date | This is the date when the transaction underlying this journal entry occurred. Today's date by default. |

| journal_desc | string | Long description of the journal entry. This is also the default description for each of this journal entry's items. |

| uom_id_statistic | string | Optional. The unit of measure for the journal line item statistic, if any. Links to an entry on the UNIT_OF_MEASURE table. This is the default statistics unit of measure for each of this journal entry's items. |

| recurring_je_number | number | Optional. This is the recurring journal entry number which was used to create this journal entry. Links to an entry on the RECURRING_JE_HEADER table. |

| processing_seq | number | Optional. This identifies the sequence in which this recurring journal entry was processed. |

| repeat_count | number | Optional. The repeat_count value from RECURRING_JE_HEADER when this occurrence was created. |

| je_status_type_id | string | This is the current journal entry status, which always starts off as 'Pending'. Links to an entry on the JOURNAL_ENTRY_STATUS_TYPE table. |

| is_posted | boolean | A YES/NO switch with an initial value of NO. Indicates if the journal entry has been posted to the general ledger, or not. |

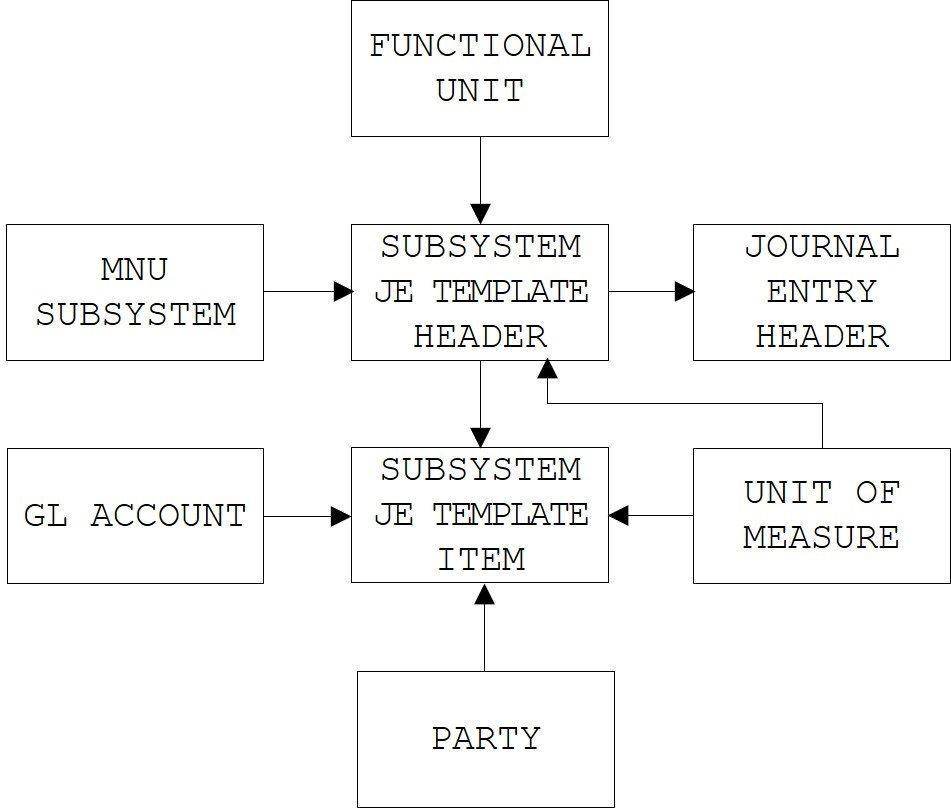

| subsys_id | string | This identifies a GM-X subsystem. Links to an entry on the MNU_SUBSYSTEM table. |

This holds accounts and amounts for each journal entry item.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| fiscal_calendar_id | number | This identifies the fiscal calendar. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| fiscal_year | number | This identifies the Gregorian year when the end of the fiscal year occurs. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| fiscal_period | number | This identifies the fiscal period. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| journal_number | number | This is the journal entry number. Each functional unit and fiscal year will have its own numbering sequence. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| journal_line_item | number | This is the journal entry line item number which is generated by the system. Journal entry line item numbers start at 1 for the first line item entered, and are incremented by 1 for each subsequent line item. |

| journal_item_desc | string | Optional. Long description. If blank then journal_desc from the JOURNAL_ENTRY_HEADER table is displayed instead. |

| party_id_transacting | number | Optional. This identifies the party (person or organisation) which is a customer, vendor, contractor or employee. Links to an entry on the PARTY table. |

| document_reference | string | Optional. This is a reference to a document (such as an invoice number, cheque number or payment reference number) or engagement (such as a project number). |

| chart_id | number | This identifies the chart of accounts. Links to an entry on the GL_ACCOUNT table. Read-only. |

| account_id | string | This identifies the general ledger account. Links to the GL_ACCOUNT table. |

| debit_functional | number | Optional. The journal line item debit amount in the functional currency. Never negative. Must be blank if the journal entry line item credit is greater than zero. |

| credit_functional | number | Optional. The journal line item credit amount in the functional currency. Never negative. Must be blank if the journal entry line item debit is greater than zero. |

| statistic | number | Optional. The journal line item statistic amount in the uom_id_statistic. |

| uom_id_statistic | string | Optional. The unit of measure for the journal line item statistic, if any. Links to an entry on the UNIT_OF_MEASURE table. If blank then the default unit of measure from the journal entry header is used instead. |

| invoice_type | string | Optional. Links to an entry on the INVOICE_HEADER table. |

| invoice_id | number | Optional. Links to an entry on the INVOICE_HEADER table. |

| invoice_adjustment_seq_no | number | Optional. Links to an entry on the INVOICE_ADJUSTMENT table. |

| invoice_item_seq_no | number | Optional. Links to an entry on the INVOICE_ITEM table. |

| invoice_item_prod_feature_id | number | Optional. Links to an entry on the INVOICE_ITEM_FEATURE table. |

| invoice_item_adjustment_seq_no | string | Optional. Links to an entry on the INVOICE_ITEM_ADJUSTMENT table. |

| VendorTxCode | string | Optional. Links to an entry on the ORDER_PAYMENT table. |

| payment_id | string | Optional. Links to an entry on the PAYMENT_HEADER table. |

| payment_line_no | number | Optional. Links to an entry on the PAYMENT_ITEM_SETTLED table. |

| payment_applied_line_no | number | Optional. Links to an entry on the PAYMENT_ITEM_APPLIED table. |

| receipt_id | number | Optional. Links to an entry on the SETTLEMENT_HEADER table. |

| receipt_line_no | number | Optional. Links to an entry on the SETTLEMENT_ITEM table. |

| receipt_applied_line_no | number | Optional. Links to an entry on the SETTLEMENT_ITEM_APPLIED table. |

| order_type | string | Optional. Links to an entry on the ORDER_HEADER table. |

| order_id | number | Optional. Links to an entry on the ORDER_HEADER table. |

| order_adjustment_seq_no | number | Optional. Links to an entry on the ORDER_ADJUSTMENT table. |

| order_item_seq_no | number | Optional. Links to an entry on the ORDER_ITEM table. |

| order_item_prod_feature_id | number | Optional. Links to an entry on the ORDER_ITEM_FEATURE table. |

| order_item_adjustment_seq_no | number | Optional. Links to an entry on the ORDER_ITEM_ADJUSTMENT table. |

| rma_id | number | Optional. Links to an entry on the RETURN_MATL_AUTH_HDR table. |

| rma_seq_no | number | Optional. Links to an entry on the RETURN_MATL_AUTH_ITEM table. |

| item_issuance_id | number | Optional. Links to an entry on the ITEM_ISSUANCE table. |

| item_receipt_id | number | Optional. Links to an entry on the ITEM_RECEIPT table. |

| variance_product_id | string | Optional. Links to an entry on the INVENTORY_ITEM_VARIANCE table. |

| variance_inventory_item_id | number | Optional. Links to an entry on the INVENTORY_ITEM_VARIANCE table. |

| variance_seq_no | number | Optional. Links to an entry on the INVENTORY_ITEM_VARIANCE table. |

| movement_product_id | string | Optional. Links to an entry on the INVENTORY_ITEM_MOVEMENT table. |

| movement_inventory_item_id | number | Optional. Links to an entry on the INVENTORY_ITEM_MOVEMENT table. |

| movement_seq_no | number | Optional. Links to an entry on the INVENTORY_ITEM_MOVEMENT table. |

| container_id | number | Optional. Links to an entry on the CONTAINER_MOVEMENT table. |

| container_movement_seq_no | number | Optional. Links to an entry on the CONTAINER_MOVEMENT table. |

| schedule_id | number | Optional. Links to an entry on the PM_SCHEDULE_HDR table. |

| activity_seq_no | number | Optional. Links to an entry on the PM_SCHEDULE table. |

| timesheet_id | number | Optional. Links to an entry on the TIMESHEET_ENTRY table. |

| timesheet_entry_seq_no | number | Optional. Links to an entry on the TIMESHEET_ENTRY table. |

| work_effort_id | number | Optional. Links to an entry on the TIMESHEET_ENTRY table. |

| day_no | number | Optional. Links to an entry on the TIMESHEET_ENTRY table. |

| event_id | number | Optional. Links to an entry on the EVENT table. |

| expense_id | number | Optional. Links to an entry on the EXPENSE_ITEM table. |

| asset_id | number | Optional. Links to an entry on the ASSET_OWNER table. |

| asset_seq_no | number | Optional. Links to an entry on the ASSET_BOOK_EVENT table. |

| facility_id | number | Optional. The facility associated with this JOURNAL_ENTRY_ITEM. Links to an entry on the FACILITY table. Required for the purpose of including the statistic value (for e.g., quantity of electrical energy consumption) in the estimate of Scope 2 greenhouse gas (GHG) emissions attributable to that facility. |

This holds user-definable journal status values. Values used by the software are defined in a system file and cannot be altered.

| Field | Type | Description |

|---|---|---|

| je_status_type_id | string | Unique identity. |

| je_status_type_name | string | Short Name |

| je_status_type_desc | string | Optional. Long description. |

| sort_seq | number | Optional. Used for sorting entries in the dropdown list. |

Here are the values used by the system which cannot be altered:

| Id | Sort Seq | Description |

|---|---|---|

| PEND | 1 | Pending completion of data entry |

| COMP | 2 | Data entry complete and balanced |

| APPR | 3 | Approved for posting |

| POST | 4 | Posted without errors |

| ERROR | 5 | Error(s) found during attempt to post |

This holds the status history for each journal entry.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| fiscal_calendar_id | number | This identifies the fiscal calendar. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| fiscal_year | number | This identifies the Gregorian year when the end of the fiscal year occurs. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| fiscal_period | number | This identifies the fiscal period. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| journal_number | number | This is the journal entry number. Each functional unit and fiscal year will have its own numbering sequence. Links to an entry on the JOURNAL_ENTRY_HEADER table. |

| seq_no | number | Sequence number which is generated by the system. |

| je_status_type_id | string | Links to an entry on the JOURNAL_ENTRY_STATUS_TYPE table. |

| status_date | date | The date on which this change was made. |

This holds the current balances and budgets for each functional unit, account and fiscal period.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept. Links to an entry on the FUNCTIONAL_UNIT table. |

| chart_id | number | This identifies the chart of accounts. Links to an entry on the GL_ACCOUNT table. |

| account_id | string | This identifies the general ledger account. Links to an entry on the GL_ACCOUNT table. |

| fiscal_calendar_id | number | This identifies the fiscal calendar. Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| fiscal_year | number | This identifies the Gregorian year when the end of the fiscal year occurs. Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| fiscal_period | number | This identifies the fiscal period. Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| debit_functional | number | Optional. The sum of all journal entry debits posted to this organisation, account and fiscal period, in the functional currency. Never negative. |

| credit_functional | number | Optional. The sum of all journal entry credits posted to this organisation, account and fiscal period, in the functional currency. Never negative. |

| period_activity | number | Optional. This is the net total of all journal entry debits less journal entry credits posted to this organisation, account and fiscal period, in the reporting currency. Blank if currency translation is not performed. |

| ending_balance | number | Optional. This is the closing balance (positive for debit balances, or negative for credit balances) for this organisation and account as at the end of this fiscal period, in the reporting currency. Blank if currency translation is not performed. Always blank for 'IC' (income) and 'EX' (expense) accounts. |

| debit_reporting | number | Optional. The system calculates this value during currency translation processing when the debit_functional value is greater than the credit_functional value for this organisation, account and fiscal period. In this case:

|

| credit_reporting | number | Optional. The system calculates this value during currency translation processing when the credit_functional value is greater than the debit_functional value for this organisation, account and fiscal period. In this case:

|

| debit_budget | number | Optional. The sum of all budget debits posted to this organisation, account and fiscal period, in the functional currency. Never negative. |

| credit_budget | number | Optional. The sum of all budget credits posted to this organisation, account and fiscal period, in the functional currency. Never negative. |

| Statistic | number | Optional. The sum of all statistics posted to this organisation, account and fiscal period, in the unit of measure specified for the account_id. May be positive or negative. |

Every Journal Entry starts off with a 'Pending' status and is not eligible for posting into the GL_ACCOUNT_PERIOD_BALANCE table until its status is changed to 'Complete'. This is not possible unless the following conditions are satisfied:

Depending on the organisation's policy journals may need to be approved before they can be posted. Posting may be done either online by selecting a journal and pressing the navigation button labelled 'Post', or by a scheduled batch job which will process all eligible journals. Once a journal has been posted it cannot be amended.

The steps taken by the journal posting process are as follows:

The idea of closing a fiscal period is to prevent any more journals from being posted into that period. Journal Entries can only be posted into the current open period or future periods. Whenever a Journal Entry is created the posting_date is used to obtain the fiscal_period which covers this date from the FISCAL_CALENDAR_PERIOD table.

A recurring journal entry is a journal entry that is recorded in every accounting period. For example, a company might record monthly rent by debiting Rental Expense for $3,000 and crediting Accounts Payable for $3,000 each and every month.

Recurring journal entries can also have identical accounts but amounts which vary by month. For example, the journal entry to record property insurance expense might involve Insurance Expense and Prepaid Insurance every month, but the amounts will change when the amount of the prepaid insurance premiums change. Other recurring entries will involve the identical accounts, but the amounts will be different in each accounting period. An example is the payroll entry. Each payroll entry will have the same accounts but different amounts due to the number of hours worked. Other examples of recurring entries with amounts that differ each period include sales, interest earned, interest expense, bank service charges, and so on.

The GM-X application also performs allocation processing using recurring journal entries created specifically for this purpose.

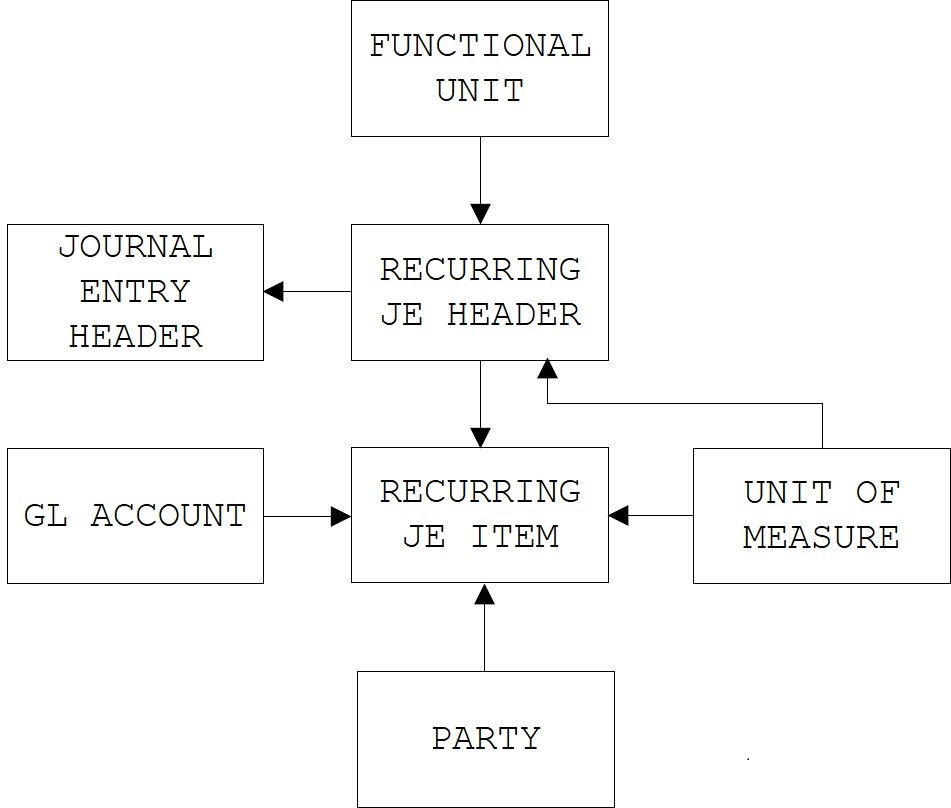

Figure 3a - Recurring Journal Entries

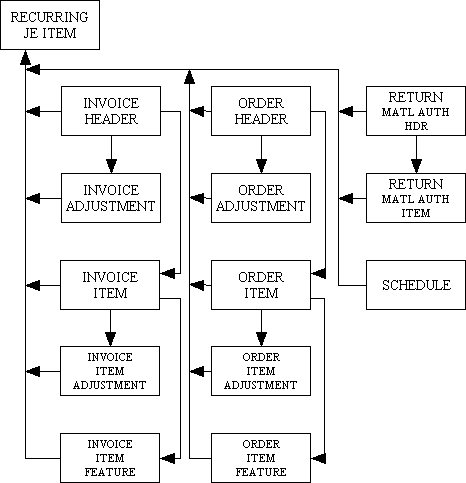

Figure 3b - Relationships with other database tables

This holds information about recurring journal entries.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the FUNCTIONAL_UNIT table. |

| recurring_je_number | number | This is the recurring journal entry number which is generated by the system. Each functional unit will have its own numbering sequence. |

| processing_seq | number | This identifies the sequence in which this recurring journal entry is processed. Each recurring journal entry will have its own processing sequence, starting at 1.

For recurring journal entries representing allocations, this setting supports "waterfall" allocations by controlling the sequence in which allocations are performed. |

| uom_id_statistic | string | Optional. The unit of measure for the recurring journal line item statistics, if any. Links to an entry on the UNIT_OF_MEASURE table. Required for recurring journal entries representing allocations. |

| effective_on | date | This is the date when the recurring journal entry first became, or will become, effective. |

| discontinue_on | date | Optional. This is the date when the recurring journal entry was, or will be, discontinued. Blank signifies an unspecified date in the future. |

| journal_desc | string | Long description of the journal entry. This is also the default description for each of this journal entry's items. |

| delay_period | number | Optional. This is used with delay_unit in order to specify the time delay before the next journal entry of this recurring series is created. It also requires that repeat_count is specified.

The repeat_count_max specifies that this recurring journal entry will be repeated this number of times. Note that delay_period and delay_unit must be used in unison - both must be either blank or both must be non-blank. |

| delay_unit | string | Optional. This defines the units for delay_period and must be one of the following:

Note that delay_period and delay_unit must be used in unison - both must be either blank or both must be non-blank. |

| repeat_count_max | number | Optional. This identifies the number of times that this recurring journal entry must be repeated after a delay of delay_period. |

| repeat_count | number | Optional. The number of times that this recurring journal entry has been repeated. If this value is less than repeat_count_max then another will be scheduled by adding the delay_period to the current date. |

This holds accounts, amounts and instructions for each recurring journal entry.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the RECURRING_JE_HEADER table. |

| recurring_je_number | number | This is the recurring journal entry number. Links to an entry on the RECURRING_JE_HEADER table. |

| journal_line_item | number | This is the journal entry line item number which is generated by the system. Journal entry line item numbers start at 1 for the first line item entered, and are incremented by 1 for each subsequent line item. |

| journal_item_desc | string | Optional. Long description. If blank then journal_desc from the RECURRING_JE_HEADER table is displayed instead. |

| party_id_transacting | number | Optional. This identifies the party (person or organisation) which is a customer, vendor, contractor or employee. Links to an entry on the PARTY table. |

| document_reference | string | Optional. This is a reference to a document (such as an invoice number, cheque number or payment reference number) or engagement (such as a project number). |

| chart_id | number | This identifies the chart of accounts. Links to an entry on the GL_ACCOUNT table. Read-only. |

| account_id | string | This identifies the general ledger account. Links to the GL_ACCOUNT table. |

| debit_functional | number | Optional. The journal line item debit amount in the functional currency. Never negative. |

| credit_functional | number | Optional. The journal line item credit amount in the functional currency. Never negative. |

| debit_statistic | number | Optional. The journal line item statistic amount in the uom_id_statistic of the row in the RECURRING_JE_HEADER table to which this journal line item is linked. Never negative. Must be blank if debit_functional or credit_functional contain values.

When one of the line items of the recurring journal entry is designated as the cost pool, if neither a debit nor credit statistic exists for that line item then the current statistical balance (if any) of the account_id will be used as the denominator when calculating the pro-rata amounts to be allocated to the other line items belonging to this recurring journal entry. For the other line items, if neither a debit nor credit statistic exists then the current statistical balance (if any) of the account_id will be used as the numerator when calculating the pro-rata amounts. |

| credit_statistic | number | Optional. The journal line item statistic amount in the uom_id_statistic of the row in the RECURRING_JE_HEADER table to which this journal line item is linked. Never negative. Must be blank if debit_functional or credit_functional contain values.

When one of the line items of the recurring journal entry is designated as the cost pool, if neither a debit nor credit statistic exists for that line item then the current statistical balance (if any) of the account_id will be used as the denominator when calculating the pro-rata amounts to be allocated to the other line items belonging to this recurring journal entry. For the other line items, if neither a debit nor credit statistic exists then the current statistical balance (if any) of the account_id will be used as the numerator when calculating the pro-rata amounts. |

| is_cost_pool | boolean | A YES/NO switch with an initial value of NO. It indicates if the current balance of the account_id for this line item is to be re-allocated to other line items belonging to this recurring journal entry, or not. Only one line item of each recurring journal entry can be designated as the cost pool (YES).

When a line item is designated as the cost pool, its statistic (credit or debit) is the denominator when calculating the pro-rata amounts to be allocated to the other line items belonging to this recurring journal entry. Otherwise, its statistic is the numerator when calculating the pro-rata amount to be allocated to this recurring journal entry line item. |

| is_rounding_receiver | boolean | A YES/NO switch with an initial value of NO. Cannot be changed to YES when the recurring journal entry line item is designated as the cost pool. Otherwise, indicates if the recurring journal entry line item receives the allocation rounding error (if any), or not. Only one recurring journal entry line item can be designated to receive the allocation rounding error. |

| invoice_type | string | Optional. Links to an entry on the INVOICE_HEADER table. |

| invoice_id | number | Optional. Links to an entry on the INVOICE_HEADER table. |

| invoice_adjustment_seq_no | number | Optional. Links to an entry on the INVOICE_ADJUSTMENT table. |

| invoice_item_seq_no | number | Optional. Links to an entry on the INVOICE_ITEM table. |

| invoice_item_prod_feature_id | number | Optional. Links to an entry on the INVOICE_ITEM_FEATURE table. |

| invoice_item_adjustment_seq_no | string | Optional. Links to an entry on the INVOICE_ITEM_ADJUSTMENT table. |

| order_type | string | Optional. Links to an entry on the ORDER_HEADER table. |

| order_id | number | Optional. Links to an entry on the ORDER_HEADER table. |

| order_adjustment_seq_no | number | Optional. Links to an entry on the ORDER_ADJUSTMENT table. |

| order_item_seq_no | number | Optional. Links to an entry on the ORDER_ITEM table. |

| order_item_prod_feature_id | number | Optional. Links to an entry on the ORDER_ITEM_FEATURE table. |

| order_item_adjustment_seq_no | number | Optional. Links to an entry on the ORDER_ITEM_ADJUSTMENT table. |

| rma_id | number | Optional. Links to an entry on the RETURN_MATL_AUTH_HDR table. |

| rma_seq_no | number | Optional. Links to an entry on the RETURN_MATL_AUTH_ITEM table. |

| schedule_id | number | Optional. Links to an entry on the SCHEDULE table. |

| activity_seq_no | number | Optional. Links to an entry on the SCHEDULE table. |

Standing Journals are saved journal entries that you use frequently and can be recalled to make manual journal entries faster.

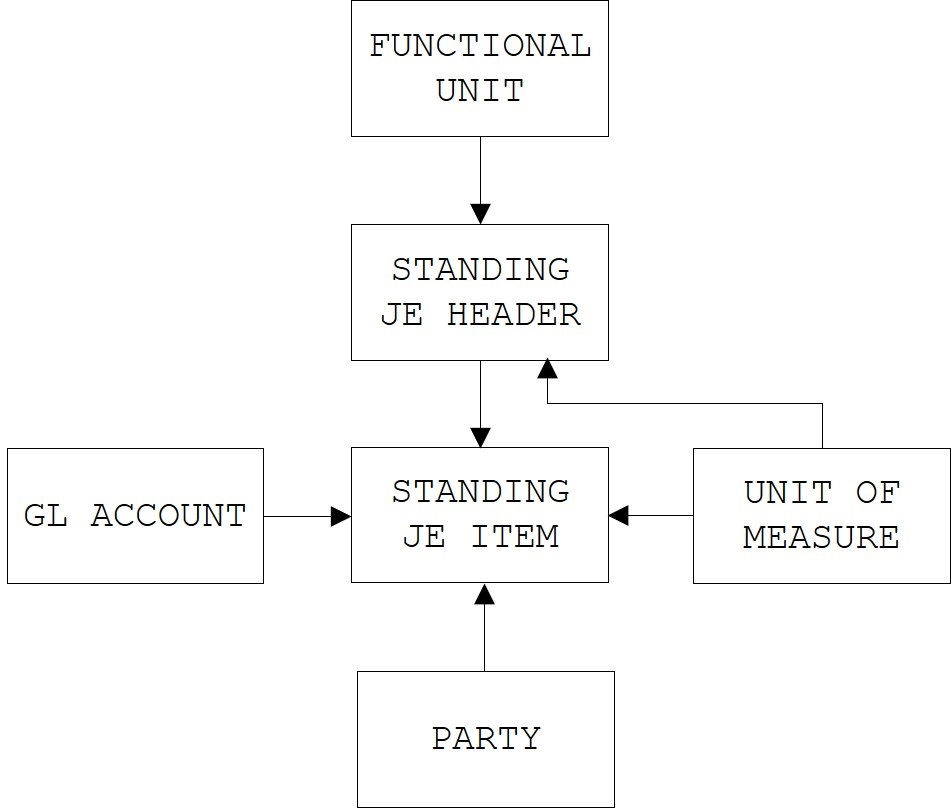

Figure 4a - Standing Journal Entries

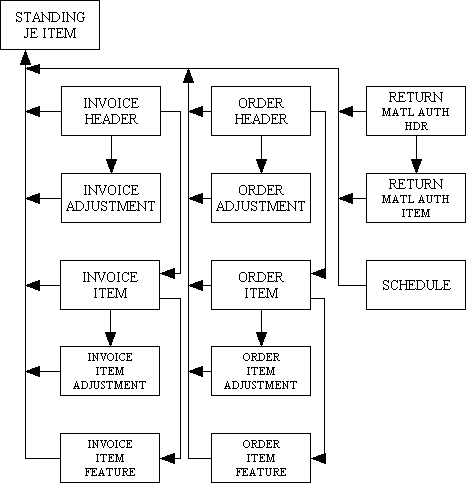

Figure 4b - Relationships with other database tables

This holds information about standing journal entries.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the FUNCTIONAL_UNIT table. |

| standing_je_number | number | This is the standing journal entry number which is generated by the system. Each functional unit will have its own numbering sequence. |

| effective_on | date | This is the date when the recurring journal entry first became, or will become, effective. |

| discontinue_on | date | Optional. This is the date when the recurring journal entry was, or will be, discontinued. Blank signifies an unspecified date in the future. |

| journal_desc | string | Long description of the journal entry. This is also the default description for each of this journal entry's items. |

| uom_id_statistic | string | Optional. The unit of measure for the standing journal line item statistic, if any. Links to an entry on the UNIT_OF_MEASURE table. This is the default statistics unit of measure for each of this standing journal entry's items. |

This holds information for each standing journal entry item.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the STANDING_JE_HEADER table. |

| standing_je_number | number | This is the recurring journal entry number. Links to an entry on the STANDING_JE_HEADER table. |

| journal_line_item | number | This is the journal entry line item number which is generated by the system. Journal entry line item numbers start at 1 for the first line item entered, and are incremented by 1 for each subsequent line item. |

| journal_item_desc | string | Optional. Long description. If blank then journal_desc from the STANDING_JE_HEADER table is displayed instead. |

| party_id_transacting | number | Optional. This identifies the party (person or organisation) which is a customer, vendor, contractor or employee. Links to an entry on the PARTY table. |

| document_reference | string | Optional. This is a reference to a document (such as an invoice number, cheque number or payment reference number) or engagement (such as a project number). |

| chart_id | number | This identifies the chart of accounts. Links to an entry on the GL_ACCOUNT table. Read-only. |

| account_id | string | This identifies the general ledger account. Links to the GL_ACCOUNT table. |

| debit_functional | number | Optional. The journal line item debit amount in the functional currency. Never negative. Must be blank if the journal entry line item credit is greater than zero. |

| credit_functional | number | Optional. The journal line item credit amount in the functional currency. Never negative. Must be blank if the journal entry line item debit is greater than zero. |

| statistic | number | Optional. The journal line item statistic amount in the uom_id_statistic. |

| uom_id_statistic | string | Optional. The unit of measure for the journal line item statistic, if any. Links to an entry on the UNIT_OF_MEASURE table. If blank then the default unit of measure from the standing journal entry header is used instead. |

| invoice_type | string | Optional. Links to an entry on the INVOICE_HEADER table. |

| invoice_id | number | Optional. Links to an entry on the INVOICE_HEADER table. |

| invoice_adjustment_seq_no | number | Optional. Links to an entry on the INVOICE_ADJUSTMENT table. |

| invoice_item_seq_no | number | Optional. Links to an entry on the INVOICE_ITEM table. |

| invoice_item_prod_feature_id | number | Optional. Links to an entry on the INVOICE_ITEM_FEATURE table. |

| invoice_item_adjustment_seq_no | string | Optional. Links to an entry on the INVOICE_ITEM_ADJUSTMENT table. |

| order_type | string | Optional. Links to an entry on the ORDER_HEADER table. |

| order_id | number | Optional. Links to an entry on the ORDER_HEADER table. |

| order_adjustment_seq_no | number | Optional. Links to an entry on the ORDER_ADJUSTMENT table. |

| order_item_seq_no | number | Optional. Links to an entry on the ORDER_ITEM table. |

| order_item_prod_feature_id | number | Optional. Links to an entry on the ORDER_ITEM_FEATURE table. |

| order_item_adjustment_seq_no | number | Optional. Links to an entry on the ORDER_ITEM_ADJUSTMENT table. |

| rma_id | number | Optional. Links to an entry on the RETURN_MATL_AUTH_HDR table. |

| rma_seq_no | number | Optional. Links to an entry on the RETURN_MATL_AUTH_ITEM table. |

| schedule_id | number | Optional. Links to an entry on the SCHEDULE table. |

| activity_seq_no | number | Optional. Links to an entry on the SCHEDULE table. |

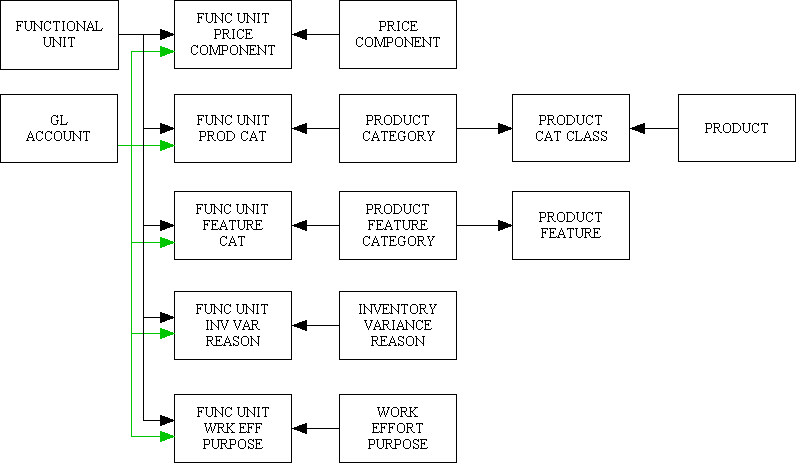

The default accounts for a business entity are defined on the FUNCTIONAL_UNIT table, but there may be situations where the default account needs to be overridden. These tables provide that ability.

Figure 5 - Default Overrides for General Ledger Accounts

This identifies various accounts that the GM-X application utilises for specific price components, if different from the default accounts utilised by the entire organisation which are held in the FUNCTIONAL_UNIT table.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the FUNCTIONAL_UNIT table. |

| price_component_id | number | This identifies a price component which affects the general ledger for one or more functional units. Links to an entry on the PRICE_COMPONENT table. |

| chart_id | number | This identifies the chart of accounts. Links to an entry on the GL_ACCOUNT table. Read-only. |

| account_id_sales_tax_payable | string | Optional. This identifies the general ledger liability account in which amounts currently owed by this organisation to the tax authority for this sales or value added tax are held, if different from the account_id_sales_tax_payable for the entire organisation. Links to an entry on the GL_ACCOUNT table. |

| account_id_tax_wh_payable | string | Optional. This identifies the general ledger liability account in which withheld corporate or personal income taxes payable to a tax authority are held for this tax rate, if different from the account_id_tax_wh_payable for the entire organisation. Links to an entry on the GL_ACCOUNT table. |

| account_id_sales_tax_liability | string | Optional. This identifies the general ledger liability account in which amounts not currently owed by this organisation to the tax authority for this sales or value added tax are held, if different from the account_id_sales_tax_liability for the entire organisation. Links to an entry on the GL_ACCOUNT table |

| account_id_sales_supply | string | Optional. This identifies the general ledger income or expense account affected by the accrual of this discount or surcharge in connection with goods supplied to customers, if different from the account_id_sales_supply for the entire organisation or for any applicable product category. Links to an entry on the GL_ACCOUNT table. |

| account_id_sales_service | string | Optional. This identifies the general ledger income or expense account affected by the accrual of this discount or surcharge in connection with services supplied to customers, or property used by (rented to, leased to or licensed by) customers, if different from the account_id_sales_service for the entire organisation or for any applicable product category. Links to an entry on the GL_ACCOUNT table. |

| account_id_exp_recovery | string | Optional. This identifies the general ledger income account affected by the accrual of surcharges derived from recovery of this nontax expense from customers, if different from the account_id_exp_recovery for the entire organisation or for any applicable product category. Links to an entry on the GL_ACCOUNT table. |

| account_id_tax_recovery | string | Optional. This identifies the general ledger income account affected by the accrual of surcharges derived by this organisation from recovery of this sales, use or output value-added tax rate from customers, if different from the account_id_tax_recovery for the entire organisation. Links to an entry on the GL_ACCOUNT table. |

| account_id_tax_reimb | string | Optional. This identifies the general ledger income or expense account affected by the accrual of taxation expenses for this sales, use or output value-added tax rate that are incurred by the organisation and are recoverable from this organisation's customers, if different from the account_id_tax_reimb for the entire organisation. Links to an entry on the GL_ACCOUNT table. |

| account_id_tax_wh_prepaid | string | Optional. This identifies the general ledger asset account in which withheld corporate or personal income taxes belonging to this organisation are held for this withholding tax rate, if different from the account_id_tax_wh_prepaid for the entire organisation. Links to an entry on the GL_ACCOUNT table. |

| account_id_tax_wh_final | string | Optional. This identifies the general ledger expense account affected by this final withholding tax rate, if different from the account_id_tax_wh_final for the entire organisation. Links to an entry on the GL_ACCOUNT table. |

This table identifies the income or expense account that the GM-X application utilises for each inventory variance reason, if different from the default accounts utilised by the entire organisation which are held in the FUNCTIONAL_UNIT table.

| Field | Type | Description |

|---|---|---|

| party_id_functional | number | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the FUNCTIONAL_UNIT table. |

| inv_var_reason_id | number | Links to an entry on the INVENTORY_VARIANCE_REASON table. |