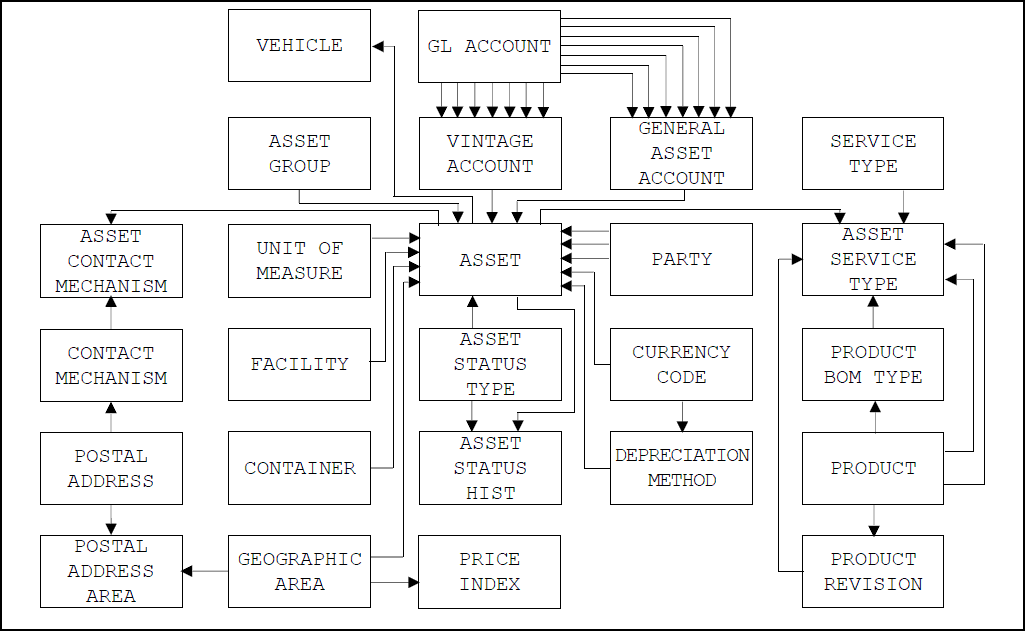

Figure 1 - Assets

20th August 2020

Amended 30th December 2024

Fixed assets management is an accounting process that tracks, for financial accounting, maintenance and theft deterrence purposes, tangible and intangible property which a business owns and uses internally or lets out to other parties. It is an important concern of all organisations, regardless of size, due to the challenges of monitoring depreciation status, location, quantity, condition and maintenance in an accurate and timely manner.

Asset tracking processes allow organisations to keep records of the assets they own, the cost and depreciation of each asset, where each asset is located, who has it, when it was checked out, when it is due for return and when it is scheduled for maintenance. The most commonly tracked assets are:

A popular tracking method uses serial-numbered asset tags, which are labels that often have bar codes. Some methods automate the tracking process using scanners to read bar codes or by attaching radio frequency identification (RFID) tags to assets. For most organisations the best automation practice follows GS1 Global Individual Asset Identifier (GIAI) and Global Returnable Asset Identifier (GRAI) standards for ID keys to assure the global uniqueness of asset tag numbers, and to make the bar codes or RFID tags readable by standard scanners or readers.

Location tracking is an important loss prevention measure which often takes one or both of two approaches. The first is to use physical tracking devices, such as global positioning system (GPS) tracking units, which provide location data in real time. The second tracks possession by responsible parties, which infers the locations of assets based upon the persons or organisations who have accepted responsibility for them.

For capital-intensive organisations, the costs and depreciation of fixed assets can have a significant impact on net income from both a financial accounting and a tax compliance perspective. Although a wide variety of depreciation methods, conventions and useful life assumptions exist for different classes of fixed assets, generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) often constrain the choices which accountants can make for particular classes of assets. It is also common for the choices allowed by tax authorities to differ from those allowed under GAAP or IFRS, and businesses may wish to exploit these differences in order to minimise their income taxes in a particular year. In this situation organisations must keep separate books for the same asset, one complying with GAAP or IFRS and another complying with tax regulations.

Regardless of how fixed assets are depreciated, organisations can minimise their costs by maintaining those assets effectively in order to minimise unplanned downtime and extend the life cycles of buildings, vehicles, equipment, machinery, furniture, fixtures and fittings. This reduces the need for new and unnecessary asset purchases over the long run. Should any damage, destruction or losses occur, an organisation's fixed asset tracking records are essential for estimating replacement costs and preparing insurance claims.

The GM-X system tracks every fixed asset in the ASSET table. Information maintained at this level is sufficient for tracking asset location, quantity, condition and maintenance.

Location tracking is optional for each asset and can be accomplished in any one or more of the following ways:

The maintenance requirements for each asset are kept on the ASSET_SERVICE_TYPE table. Each entry on this table represents a particular maintenance, repair or overhaul procedure recommended by the manufacturer for corrective, preventive or predictive maintenance.

The PARTY, ORGANISATION and PERSON tables contain entries for every organisation or person which is required to be known to the GM-X application.

At least one of these parties is an organisation which is the "client" and it is the one for which the application is being run. This organisation is known as the "functional unit" and can be identified by adding it to the PARTY and ORGANISATION tables using a single party_id. This data provides the following:

It is also possible for a GM-X installation to handle the business for a group of organisations which do business under separate names, possibly using different functional currencies. Those organisations can be added as functional units to the PARTY and ORGANISATION tables. Each of them is identified in those tables by its own party_id.

The GM-X application can maintain separate general ledgers for these organisations. In this case each of those organisations must be added as a business entity to the FUNCTIONAL_UNIT table using its party_id, in addition to the PARTY and ORGANISATIONN tables.

When the GM-X application handles the business for a group of business entities, it is possible for those entities to share the ownership of a single asset. It is also possible for an external party to share the ownership of an asset when the GM-X application handles the business for a single business entity, or a group of business entities, which also partly own the asset. In these situations, separate entries will exist on the ASSET_OWNER table for each owner of an asset who is a functional unit, and each such owner's ownership_pct is recorded in its ASSET_OWNER entry.

For each of those entities, it may be convenient or necessary for tax compliance reasons to group assets together into general asset accounts. The grouped assets must have the same life, method of depreciation, convention, additional first year depreciation percentage, and year (or quarter or month) placed in service. Certain classes of property, such as vehicles, cannot be grouped with other assets. Depreciation for a general asset account is computed as if the entire account were a single asset. The general asset account to which a particular asset belongs, if any, is the general_asset_account_id on the ASSET table.

Similarly, it may be necessary for historical tax compliance reasons to group assets together into "vintage accounts" consisting of all assets within a class acquired in a particular tax year. Each asset class prescribes useful lives based on the nature or use of the asset. These include general classes such as office equipment as well as industry classes such as assets used in the manufacture of rubber goods. Like general asset accounts, depreciation for a vintage account is computed as if the entire account were a single asset. The vintage account to which a particular asset belongs, if any, is the vintage_account_id on the ASSET table.

If neither method of grouping is required or desired, then depreciation is computed for individual assets.

The GM-X application also provides a third user-defined asset grouping method. The group to which a particular asset belongs, if any, is the asset_group_id on the ASSET table. This method of classifying assets has no impact on depreciation calculations, but is useful when each group of assets is tracked or managed by different departments or personnel within an organisation.

Each of the entities which owns an asset may optionally choose to depreciate it using multiple alternative methods; for example when depreciating assets according to GAAP or IFRS and when depreciating the same assets in the manner prescribed by the relevant tax authorities. Accordingly, one or more entries will exist on the ASSET_OWNER_BOOK table for:

Each entry on the ASSET_OWNER_BOOK table has an asset_book_type_id which links to an entry on the ASSET_BOOK_TYPE table. Each entry on the ASSET_BOOK_TYPE table is user-defined and identifies the purpose of the book; for e.g. "U. S. GAAP" and "U. S. MACRS" (the Modified Accelerated Cost Recovery System which United States taxpayers must use).

Although there is theoretically a nearly limitless number of depreciation books which may be maintained for an individual asset, general asset account or vintage account, no more than three should ever be needed in usual practice. When multiple alternative books are maintained, only one of those books can affect the general ledger as indicated by affects_gl on its ASSET_BOOK_TYPE entry. Therefore, among all the ASSET_BOOK_TYPE entries included on the ASSET_OWNER_BOOK table for a particular asset, general asset account or vintage account, only one of their affects_gl values may indicate YES.

Depreciation is normally calculated on a periodic basis for each entry on the ASSET_OWNER_BOOK table, and the results are stored on the ASSET_BOOK_PERIOD table together with any additional first year depreciation, related expense deductions (for e.g. the Section 179 depreciation deduction in the United States) and income realised from the splitting or disposition of assets.

The GM-X application maintains an event history for each asset over its life cycle. The table below describes the 13 different types of events which are tracked:

| Event Type | Description | Affects GL? |

|---|---|---|

| construction | Value was added to (or removed from) an asset under construction (AUC) by way of a supplier invoice, supplier credit note, supplier debit note, inventory item issuance, timesheet entry or expense entry. None of the cumulative value added to the AUC may be depreciated until the asset is capitalised. | |

| expensed | The asset was placed into service and wholly or partially expensed. The expensed amount (which cannot exceed the cumulative value added to the AUC) credits an 'auc' asset account and debits an 'expense' account in the general ledger. | Yes |

| capitalised | The asset was placed into service and capitalised. The cumulative value remaining for the AUC (after deducting any expensed amount) credits an 'auc' asset account and debits an 'ffe' (furniture, fixtures and equipment) asset account in the general ledger. | Yes |

| checkout | The asset was checked out to a responsible party. The party_id_issued_to value on the ASSET table changed from blank to the party_id for an ORGANISATION or PERSON. | |

| checkin | The asset was returned by the responsible party. The party_id_issued_to on the ASSET table changed from the party_id for an ORGANISATION or PERSON to blank. | |

| depreciated | The asset was wholly or partially depreciated during a period. The depreciation amount credits an 'accum_depreciation' (accumulated depreciation) contra asset account and debits a 'depreciation' expense account in the general ledger. | Yes |

| fault | The asset suffered a fault or breakdown requiring corrective maintenance. | |

| impaired | The asset sustained a loss, damage or destruction which requires its remaining value to be wholly or partially written off. The cause of the impairment could be a casualty, depletion (for e.g. using up natural resources by mining, quarrying, drilling, or felling) or an accounting provision (for e.g. losses arising when market prices fall below the value listed on the balance sheet, which may be supported by an independent appraisal). The impairment amount credits the 'ffe' asset account. Any accumulated depreciation attributable to the impairment amount will be reversed by debiting the 'accum_depreciation' contra asset account, and any difference between the impairment amount and reversal of accumulated depreciation will debit the 'impairment' expense account. | Yes |

| serviced | Corrective, preventive or predictive maintenance was completed for the asset | |

| split | The asset was split into two or more new assets. The 'ffe' asset account and 'accum_depreciation' contra asset account for the former asset will be transferred to the 'ffe' asset account and 'accum_depreciation' contra asset accounts for the new assets. | Yes |

| retired | The asset was withdrawn from service, having reached the end of its useful life. | |

| disposed | The asset was sold or scrapped. The 'ffe' asset account and 'accum_depreciation' contra asset account will be reversed in the amounts attributable to the asset. Any income realised from the sale or scrap will credit the 'disposal' income or expense account. | Yes |

| appraised | The asset was appraised. |

The event history for each asset also includes an optional history of data point values, or "dots", for various characteristics that are measured periodically. Although these measurements may be taken manually and entered into the GM-X system using the Add Asset Event task, more commonly such measurements are made by sensors and passed automatically to the GM-X system by way of an application program interface (API). Either way, the dots are stored in the ASSET_EVENT table.

Figure 1 - Assets

This provides basic information for individual assets.

| Field | Type | Description |

|---|---|---|

| asset_id | numeric | This is a unique identifier which is generated by the system.

The leftmost 12 digits of this value consists of the participant_id, left filled with zeroes so it always occupies 12 digits; and If the gs1_standard value is 'R' then the rightmost 26 digits of this value are generated so the leftmost numeral is zero ('0') followed by the gs1_asset_type value, left filled with zeroes so it always occupies 9 digits; and then followed by 16 digits composed as follows:

|

| asset_name | string | Short name. |

| asset_desc | string | Optional. Long description. |

| gs1_standard | string | This indicates which GS1 standard, if any, is used to compose the asset_tag_no value, which can be one of the following:

|

| asset_tag_no | string | Read-only. This is the full asset tag number composed by the system which is printed on labels or bar codes, or recorded onto radio frequency identification (RFID) chips. Must be unique within the ASSET table.

To assure global uniqueness when the GS1 GIAI or GRAI standard applies, or uniqueness within a blockchain network, the leftmost segment of this value always contains the participant_id. If the value of gs1_standard is 'R':

ELSE begin with the value of participant_id, left filled with a zero ('0') if necessary so the participant_id occupies the number of digits in the participant_id + value of is_upc_co_prefix. Then, if the value of gs1_standard is 'I' or serial_number_native is blank:

|

| participant_id | numeric | This identifies the GM-X blockchain node and/or an organisation having a GS1 Company Prefix which is responsible for issuing gs1_asset_type and serial_number_gs1 numbers that identify the asset. Its precision is 12 and its scale is zero (0). Users are allowed to maintain this value only when adding a new asset. The default value is the Participant ID assigned to this GM-X instance. |

| is_upc_co_prefix | boolean | Indicates if a GS1 U.P.C. Company Prefix must be derived from the participant_id (1) or not (0). Always zero (0) if the number of digits in the participant_id value = 12; otherwise the default value is the value of IS_UPC_CO_PREFIX from Fixed Asset controls. |

| gs1_asset_type | numeric | Optional. This is the part of the asset_tag_no representing the asset type utilised by the GS1 Global Returnable Asset Identifier (GRAI) standard. Its scale is zero (0). Users are allowed to maintain this value only when adding a new asset.

If the gs1_standard value is 'R' then this entry is required, and:

If the gs1_standard value is not 'R' then this entry must be blank. |

| serial_number_gs1 | numeric | This is the serial number which specifically identifies an individual asset. Its precision is 26 and its scale is zero (0). Users are allowed to maintain this value only when adding a new asset.

If the gs1_standard value is 'R' then the minimum allowable value is one (1) and the maximum allowable value is 9,999,999,999,999,999. If the gs1_standard value is not 'R' then:

If this entry is left blank then the system will supply an auto-incremented value for this field when it generates the asset_id. |

| serial_number_native | string | Optional. This is the native serial number or vehicle identification number (VIN), if any, allocated by the manufacturer or owner of the asset. Maximum 17 characters for a VIN. |

| party_id_manufacturer | numeric | Optional. This identifies the person or organisation who manufactured the asset, if any. Links to an entry on the PARTY table. |

| model | string | Optional. The model name or model description assigned by the asset manufacturer. |

| party_id_issued_to | numeric | Optional. This identifies the person or organisation, if any, who most recently checked out or accepted responsibility for the asset. Links to an entry on the PARTY table. |

| party_id_servicer | numeric | Optional. This identifies the person or organisation who is currently responsible for servicing the asset, if any. Links to an entry on the PARTY table. |

| service_contract_no | string | Optional. This is the user-defined identity of the contract with party_id_servicer. |

| currency_code | string | This is the transaction currency in which all monetary amounts for the asset are denominated, including the asset_cost_tx and salvage_value_tx values. Links to an entry on the CURRENCY_CODE table. |

| asset_cost_tx | numeric | This is the cost of the asset at the time it was placed into service and capitalised. This value cannot be modified after the asset is capitalised. Its value will accumulate between the date_construction_start and date_capitalised. |

| salvage_value_tx | numeric | This is the estimated salvage value of the asset at the time it was placed into service and capitalised. This value cannot be modified after the asset is capitalised. |

| date_construction_start | date | Optional. This is the date when construction of the asset started. May not be later than the date_capitalised. This value cannot be modified after the asset is capitalised. |

| date_capitalised | date | Optional. This is the date when the asset was placed into service. May not be earlier than the date_construction_start. This value cannot be modified after the asset is capitalised. |

| date_licence_expiry | date | Optional. This is the date when licence to use the asset expires. Blank signifies an unspecified date in the future. |

| date_next_appraisal | date | Optional. This is the date when the next appraisal is scheduled. Blank signifies an unspecified date in the future. |

| useful_life_months | numeric | This is the useful life of the asset, in Gregorian months. May not be less than zero (0). |

| date_time_checked_out | datetime | Optional. This is the date and time when the asset was last checked out. If not blank, may not be earlier than 0:00:00 hours on the date_capitalised. |

| date_time_scheduled_return | datetime | Optional. This is the date and time when the asset is (or was) due to be returned. A value may be entered only if date_time_checked_out is nonblank. If not blank, may not be earlier than the date_time_checked_out. |

| date_last_repaired | date | Optional. This is the date when the asset was last repaired or serviced. May not be earlier than the date_capitalised. |

| cycles_cumulative | numeric | Optional. This is the number of cycles which the asset has operated since it was placed into service. |

| cycles_current | numeric | Optional. This is the number of cycles which the asset has operated since preventive maintenance was last performed. It is used together with the cycle_interval on the ASSET_SERVICE_TYPE table to determine when the next preventive maintenance needs to be performed. |

| uom_id_cycle | string | Optional. This is the unit of measure for the cycles value. Links to an entry on the UNIT_OF_MEASURE table. |

| date_retired | date | Optional. This is the date when the asset was withdrawn from service, having reached the end of its useful life or become redundant. May not be earlier than the date_capitalised. |

| date_disposed | date | Optional. This is the date when the asset was disposed of. May not be earlier than the date_capitalised. |

| depreciation_method_id | numeric | Optional. This is the primary or default method for depreciating or amortising the asset as reflected on the owners' general ledgers. Links to an entry on the DEPRECIATION_METHOD table. |

| asset_group_id | string | Optional. This is the group to which the asset belongs. Links to an entry on the ASSET_GROUP table. |

| vintage_account_id | string | Optional. This is the vintage account in which the asset is grouped. Each vintage account comprises all assets of a particular class that were acquired during a particular tax year. Depreciation for a vintage account is computed as if the entire account were a single asset. Links to an entry on the VINTAGE_ACCOUNT table and the date_capitalised must fall on or between the tax_period_start_date and tax_period_end_date of that entry. Read-only if any ASSET_OWNER_BOOK entries exist for the vintage_account_id and at least one ASSET_BOOK_PERIOD exists for at least one of those ASSET_OWNER_BOOK entries. |

| general_asset_account_id | string | Optional. This is the vintage account in which the asset is grouped. Each general asset account comprises all assets of a particular class that were acquired during a particular tax year. Depreciation for a general asset account is computed as if the entire account were a single asset. Links to an entry on the GENERAL_ASSET_ACCOUNT table and the date_capitalised must fall on or between the tax_period_start_date and tax_period_end_date of that entry. Read-only if any ASSET_OWNER_BOOK entries exist for the general_asset_account_id and at least one ASSET_BOOK_PERIOD exists for at least one of those ASSET_OWNER_BOOK entries. |

| asset_status_type_id | string | Optional. This is the asset's current status. Links to an entry on the ASSET_STATUS_TYPE table. |

| is_active | boolean | A YES/NO switch with an initial value of NO. It indicates if the asset is currently in service, or not. Automatically changed to YES when the asset is capitalised or expenses, or when repairs or service are completed. Automatically changed to NO when the asset is retired or disposed. |

| area_id | numeric | Optional. This is the geographic area where the asset is currently located. Links to an entry on the GEOGRAPHIC_AREA table. |

| facility_id | numeric | Optional. This is the facility where the asset is currently located. Links to an entry on the FACILITY table. |

| container_id | numeric | Optional. This is the container in which the asset is currently located. Links to an entry on the CONTAINER table. |

| inv_container_id | numeric | Optional. Required only if the asset is a container that is utilised by the INVENTORY subsystem. Links to an entry on the CONTAINER table. Must be unique within the ASSET table. |

| is_moveable | boolean | A YES/NO switch with an initial value of NO. It indicates if the asset is intangible or ordinarily situated at a single location (NO), such as land or buildings, or not (YES), such as vehicles. |

| latitude | numeric | Optional. This is the geographic latitude of the asset's current location in degrees. Alternatively it may be the 'X' coordinate in a local coordinates system. Required if longitude or altitude are nonblank. |

| longitude | numeric | Optional. This is the geographic longitude of the asset's current location in degrees. Alternatively it may be the 'Y' coordinate in a local coordinates system. Required if latitude or altitude are nonblank. |

| altitude | numeric | Optional. This is the geographic altitude of the asset's current location. Alternatively it may be the 'Z' coordinate in a local coordinates system. Required if latitude or longitude are nonblank. Must be zero (0) for two-dimensional coordinates systems. |

| licence_location | string | Optional. This describes the location of the licence to use the asset. |

| asset_comments | string | Optional. This contains free-form notes, comments and/or remarks about the asset. |

| sector_id | numeric | Optional. The industry sector associated with usage of the asset for the purpose of estimating Scope 1 greenhouse gas (GHG) emissions from stationary combustion. Allowable values are:

|

This indicates which CONTACT_MECHANISMs are used by which ASSETs.

| Field | Type | Description |

|---|---|---|

| asset_id | numeric | Links to an entry on the ASSET table. |

| contact_mechanism_id | numeric | Links to an entry on the CONTACT_MECHANISM table. |

| seq_no | numeric | Unique sequence number assigned by the system. |

| start_date | date | Indicates the start date for this entry. |

| end_date | date | Optional. Indicates the end date for this entry. Blank signifies an unspecified date in the future. |

| extension | numeric | Optional. Extension number for telephone contacts. |

| contact_notes | string | Optional. Free format text. |

Here are some examples:

| Asset | Mechanism | Description |

|---|---|---|

| Server GPTUSMN01 | 601 Carlson Parkway, Minneapolis, MN 55305 USA | Postal address of server location |

| Server GPTUSMN01 | gptusmn01.geoprise.com | Internet address (URL) of server |

| Server GPTUSMN01 | 19QePq6ALgrYNUQYkp6WVWbqU9s2WcBmSd3C3m | Blockchain node address of server |

| Server GPTUSMN01 | +1 (612) 234 0958 | Administrator phone number |

| Punch press A6493 | 7998 Bush Lake Road, Minneapolis, MN 55305 USA | Postal address of asset location |

| Punch press A6493 | +1 (612) 356 4898 | Emergency telephone number |

This is the optional history of data points ("dots") for each asset and characteristic.

| Field | Type | Description |

|---|---|---|

| asset_event_id | numeric | Unique sequence number assigned by the system. |

| asset_id | numeric | Links to an entry on the ASSET table. |

| characteristic_id | string | The name of the measured characteristic (characteristics may also be known as "variables" or "attributes"). |

| characteristic_value | string | Optional. The measurement value for this data point or "dot". Note that the meausrement timestamp is stored in the standard created_date column. |

| is_evaluated | boolean | A YES/NO switch with an initial value of NO. It indicates if this data point ("dot") has been evaluated yet within the GM-X system (YES), or not (NO). |

This identifies the names of groups to which assets can belong.

| Field | Type | Description |

|---|---|---|

| asset_group_id | string | Unique identity assigned by the user. |

| asset_group_name | string | Short name. |

| asset_group_desc | string | Optional. Long description. |

Here are some examples:

This holds information about the types of maintenance, repair and overhaul services which can be performed for specific assets.

| Field | Type | Description |

|---|---|---|

| asset_id | numeric | Links to an entry on the ASSET table. |

| service_type_id | string | Links to an entry on the SERVICE_TYPE table. |

| start_date | date | The earliest date when this type of service is available for this asset. Today's date by default. |

| end_date | date | Optional. The latest date when this type of service is available for this asset. If blank then this type of service is available indefinitely.

When the value of is_warranty_service for the service_type_id is YES then this entry contains the warranty expiry date. |

| maintenance_fee_tx | numeric | Optional. The maintenance fee for the period between and including the start_date and end_date, denominated in the currency_code of the ASSET. |

| service_subtype | string | Either CORRECTIVE, PREVENTIVE or PREDICTIVE.

Corrective maintenance is performed urgently to recover from faults and equipment breakdowns. Preventive maintenance is performed at periodic intervals, according to the original equipment manufacturer's (OEM) recommendation, based upon either the passage of time (for e.g. "change oil every 3 months") or actual operating cycles (for e.g. "change oil every 5,000 kilometres"). Predictive maintenance uses algorithms to predict the future failure points of equipment components, so that the components can be replaced, based on a plan, just before they fail. |

| product_id_service | string | Optional. This is the identity of the required service. Links to an entry on the PRODUCT table which must have a product_subtype of 'S' (Service). |

| product_id_kit | string | Optional. This is the identity of the required kit for performing the service. Links to an entry on the PRODUCT_BOM_TYPE table which must refer to an entry on the PRODUCT table that has a product_subtype of 'G' (Good), and should refer to a product which has a kitting bill of materials (BOM), denoted by bom_type_id, that must be provided in order to perform the service. |

| bom_type_id | string | Optional. This is the BOM type for the kitting BOM that must be provided in order to perform the service. Must be blank if product_id_kit is blank. |

| revision_id | string | Optional. This is the revision number of the required kit for performing the service. Required if product_id_kit refers to an entry on the PRODUCT table having an is_revision_controlled value of YES. Must be blank if product_id_kit is blank. |

| service_interval | numeric | Optional. This is the maximum amount of time, in days, recommended by the OEM between preventive maintenance activities of this service type for this asset. |

| cycle_interval | numeric | Optional. This is the maximum number of cycles recommended by the OEM between preventive maintenance activities of this service type for this asset, in the asset's uom_id_cycle. |

This holds information about each asset status.

| Field | Type | Description |

|---|---|---|

| asset_status_type_id | string | Unique identity assigned by the user. |

| asset_status_type_name | string | Short name |

| asset_status_type_desc | string | Optional. Long description. |

| sort_seq | numeric | Optional. Used for sorting entries in the dropdown list. |

Here are the values used by the system which cannot be altered:

| Id | Description | Sequence |

|---|---|---|

| AUC | Under construction | 1 |

| APPR | Approved | 2 |

| EXP | Expensed | 3 |

| CAP | Placed into service and capitalised | 4 |

| OUT | Checked out | 5 |

| IN | Checked in | 6 |

| UP | Up and running | 7 |

| DOWN | Down due to fault, impairment, maintenance or repairs | 8 |

| SPLT | Split to create two or more other assets | 9 |

| RET | Retired | 10 |

| MISS | Missing | 11 |

| FND | Found (previously reported missing) | 12 |

| DSP | Disposed | 13 |

This holds the status history for each asset.

| Field | Type | Description |

|---|---|---|

| asset_id | numeric | Links to an entry on the ASSET table. |

| seq_no | numeric | Sequence number which is generated by the system. |

| asset_status_type_id | string | Links to an entry on the ASSET_STATUS_TYPE table. |

| status_date | date | The date on which this change was made. |

This holds information about the methods of depreciation or amortisation which can be utilised to measure the capital consumption of assets.

| Field | Type | Description |

|---|---|---|

| depreciation_method_id | numeric | Identity number which is assigned automatically by the system, starting at 1 and incrementing by 1. |

| depreciation_method_name | string | Short name. |

| depreciation_method_desc | string | Optional. Long description. |

| depreciation_method_type | numeric | This identifies the depreciation formula:

|

| rounding_factor | numeric | This specifies the decimal place (zero or 2) of depreciation calculation results to be rounded up or down. |

| fixed_percent | numeric | Optional. This contains the percentage to use in the depreciation formula. Nonblank entries must be greater than zero (0) and less than 100.

An entry is required if the depreciation_method_type is any of the following:

|

| bonus_percent | numeric | Optional. This contains the applicable bonus depreciation percent, if any. Nonblank entries must be greater than zero (0) and less than 100. |

| convention_type | string | This identifies the convention to use for calculating depreciation during the first year an asset is placed into service:

|

| depreciation_method_rule | string | Optional. This identifies a class file which is used to calculate the properties of each day within a calendar year. This value is required when depreciation_method_type is 99 (Custom formula) and ignored for other values. |

| max_deduction_amount | numeric | Optional. This is the maximum amount that can be deducted per year, denominated in the currency_code. |

| currency_code | string | This is the currency in which the max_deduction_amount is denominated. Links to an entry on the CURRENCY_CODE table. |

This identifies the names of general asset accounts in which assets can be grouped for the purpose of calculating depreciation or amortisation. Each general asset account comprises all assets of a particular class that were acquired during a particular tax year, quarter or month. Depreciation for a general asset account is computed as if the entire account were a single asset.

| Field | Type | Description |

|---|---|---|

| general_asset_account_id | string | Unique identity assigned by the user. |

| general_asset_account_name | string | Short name. |

| general_asset_account_desc | string | Optional. Long description. |

| tax_period_start_date | date | This is the starting date of the tax period. Read-only if any ASSET entries are linked to this general_asset_account_id. |

| tax_period_end_date | date | This is the ending date of the tax period. Cannot be earlier than the tax_period_start_date and the difference between this value and the tax_period_start_date cannot exceed one Gregorian year. If the difference between this value and the tax_period_start_date is less than one year then it cannot exceed three (3) Gregorian months (i.e. one calendar quarter). If the difference between this value and the tax_period_start_date is less than one calendar quarter then it cannot exceed one Gregorian month. Read-only if any ASSET entries are linked to this general_asset_account_id. |

| chart_id | numeric | Optional. This identifies the chart of accounts. Links to an entry on the GL_ACCOUNT table. The account_id_auc, account_id_ffe, account_id_accum_depreciation, account_id_expense, account_id_depreciation, account_id_impairment and account_id_disposal, if any, must all belong to the same chart of accounts. |

| account_id_auc | string | Optional. This identifies the default general ledger asset account to be debited when value is added to an asset under construction (AUC) belonging to this general asset account. Links to an entry on the GL_ACCOUNT table. |

| account_id_ffe | string | Optional. This identifies the default general ledger asset account to be debited when an asset belonging to this general asset account is capitalised and placed into service. Links to an entry on the GL_ACCOUNT table. |

| account_id_accum_depreciation | string | Optional. This identifies the default general ledger contra asset account to be credited when this general asset account is depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_expense | string | Optional. This identifies the default general ledger expense account to be debited when an asset belonging to this general asset account is expensed instead of depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_depreciation | string | Optional. This identifies the default general ledger expense account to be debited when this general asset account is depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_impairment | string | Optional. This identifies the default general ledger expense account to be debited when an asset belonging to this general asset account is impaired. Links to an entry on the GL_ACCOUNT table. |

| account_id_disposal | string | Optional. This identifies the default general ledger income account to be credited when an asset belonging to this general asset account is disposed of. Links to an entry on the GL_ACCOUNT table. |

This holds official price deflator data such as a consumer price index (CPI), allowing an asset's estimated replacement cost to be calculated for insurance purposes.

| Field | Type | Description |

|---|---|---|

| area_id | numeric | This is the geographic area to which the data applies. Links to an entry on the GEOGRAPHIC_AREA table. |

| year | numeric | This is the year. The minimum allowable value is 1 and the maximum allowable value is 9999. |

| month | numeric | This is the Gregorian month. The minimum allowable value is 1 and the maximum allowable value is 12. |

| deflator | numeric | This is the deflator. All entries must be greater than zero. |

This holds information about the types of maintenance, repair and overhaul services which can be performed for assets.

| Field | Type | Description |

|---|---|---|

| service_type_id | string | Unique identity assigned by the user. |

| service_type_name | string | Short name. |

| service_type_desc | string | Optional. Long description. |

| is_warranty_service | boolean | A YES/NO switch with an initial value of NO. It indicates if this type of service is provided under an asset's warranty, or not. |

Here are some examples:

This identifies the names of vintage accounts in which assets can be grouped for the purpose of calculating depreciation or amortisation. Each vintage account comprises all assets of a particular class that were acquired during a particular tax year. Depreciation for a vintage account is computed as if the entire account were a single asset.

| Field | Type | Description |

|---|---|---|

| vintage_account_id | string | Unique identity assigned by the user. |

| vintage_account_name | string | Short name. |

| vintage_account_desc | string | Optional. Long description. |

| tax_period_start_date | date | This is the starting date of the tax period. Read-only if any ASSET entries are linked to this vintage_account_id. |

| tax_period_end_date | date | This is the ending date of the tax period. Cannot be earlier than the tax_period_start_date and the difference between this value and the tax_period_start_date cannot exceed one Gregorian year. If the difference between this value and the tax_period_start_date is less than one year then it cannot exceed three (3) Gregorian months (i.e. one calendar quarter). If the difference between this value and the tax_period_start_date is less than one calendar quarter then it cannot exceed one Gregorian month. Read-only if any ASSET entries are linked to this vintage_account_id. |

| chart_id | numeric | Optional. This identifies the chart of accounts. Links to an entry on the GL_ACCOUNT table. The account_id_auc, account_id_ffe, account_id_accum_depreciation, account_id_expense, account_id_depreciation, account_id_impairment and account_id_disposal, if any, must all belong to the same chart of accounts. |

| account_id_auc | string | Optional. This identifies the default general ledger asset account to be debited when value is added to an asset under construction (AUC) belonging to this general asset account. Links to an entry on the GL_ACCOUNT table. |

| account_id_ffe | string | Optional. This identifies the default general ledger asset account to be debited when an asset belonging to this general asset account is capitalised and placed into service. Links to an entry on the GL_ACCOUNT table. |

| account_id_accum_depreciation | string | Optional. This identifies the default general ledger contra asset account to be credited when this general asset account is depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_expense | string | Optional. This identifies the default general ledger expense account to be debited when an asset belonging to this general asset account is expensed instead of depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_depreciation | string | Optional. This identifies the default general ledger expense account to be debited when this general asset account is depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_impairment | string | Optional. This identifies the default general ledger expense account to be debited when an asset belonging to this general asset account is impaired. Links to an entry on the GL_ACCOUNT table. |

| account_id_disposal | string | Optional. This identifies the default general ledger income account to be credited when an asset belonging to this general asset account is disposed of. Links to an entry on the GL_ACCOUNT table. |

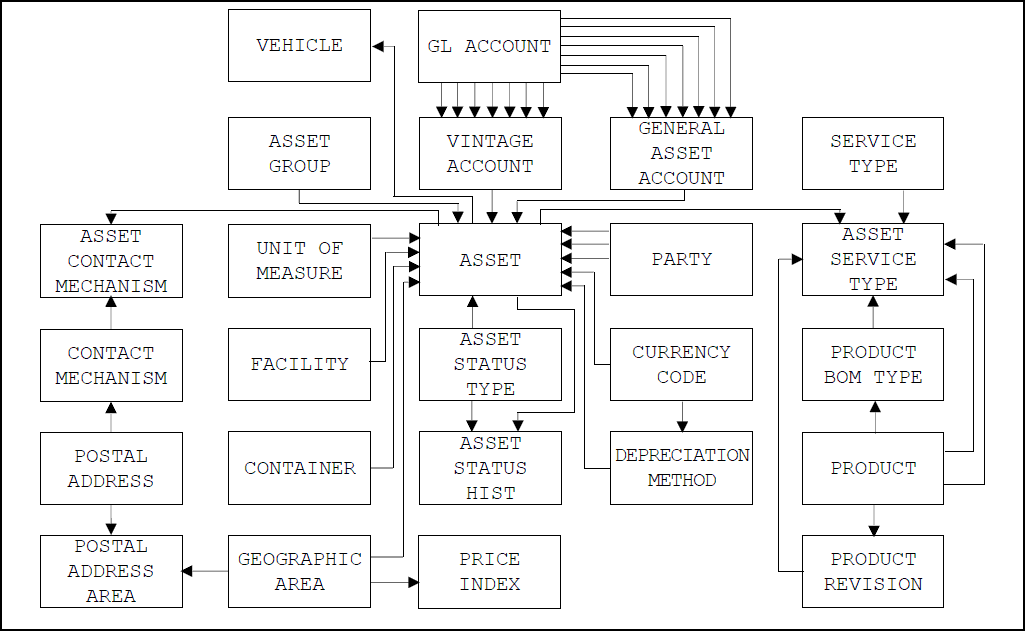

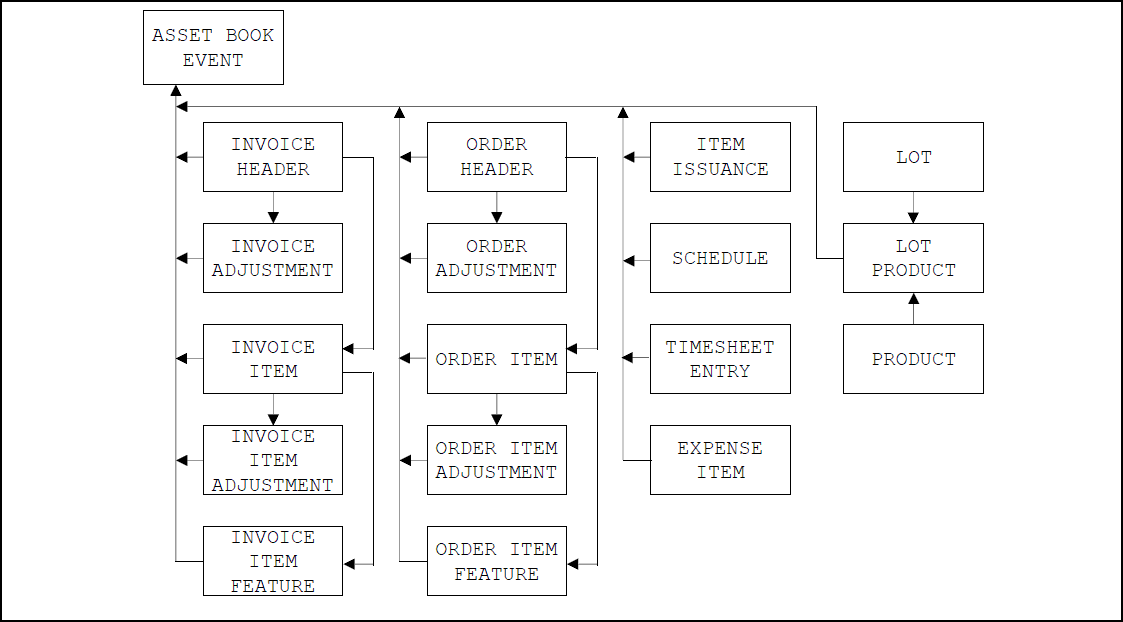

Figure 2 - Depreciation Books

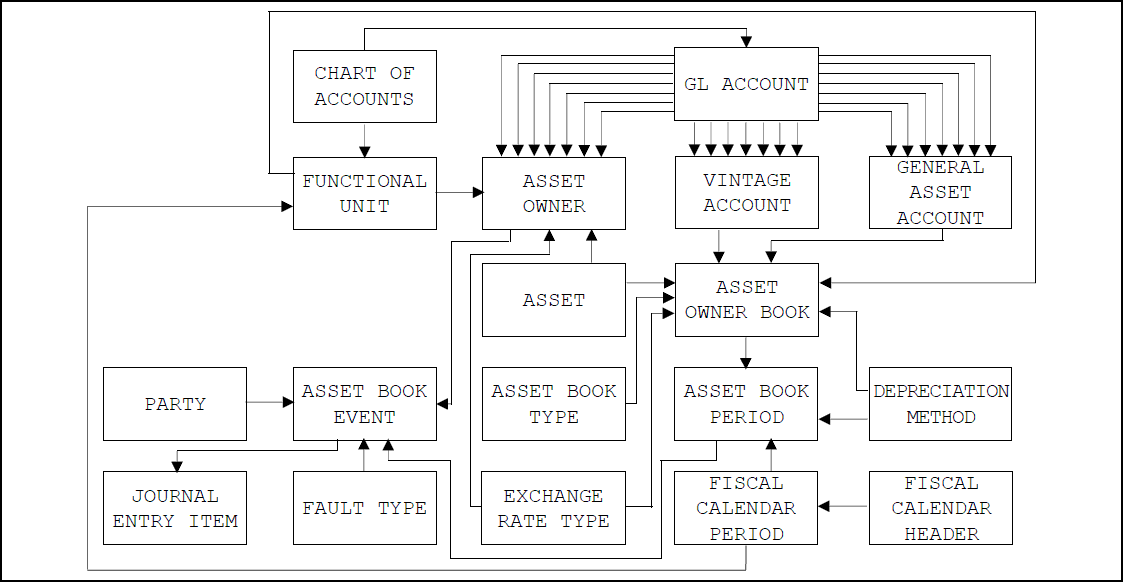

Figure 3 - Depreciation Book References

This contains the event history for each asset and its owners.

| Field | Type | Description |

|---|---|---|

| asset_id | numeric | Links to an entry on the ASSET_OWNER table. |

| party_id_functional | numeric | Links to an entry on the ASSET_OWNER table. |

| asset_seq_no | numeric | Sequence number generated by the system, starting at 1 and incrementing by 1. |

| asset_book_type_id | string | Optional. Links to an entry on the ASSET_BOOK_PERIOD table. Required if event_type_id is 2 (Capitalised), 5 (Depreciated), 6 (Expensed), 8 (Impaired), 10 (Split) or 12 (Disposed). |

| asset_owner_book_id | numeric | Optional. Links to an entry on the ASSET_BOOK_PERIOD table. Required if event_type_id is 2 (Capitalised), 5 (Depreciated), 6 (Expensed), 8 (Impaired), 10 (Split) or 12 (Disposed). |

| fiscal_calendar_id | numeric | Optional. Links to an entry on the ASSET_BOOK_PERIOD table. Required if event_type_id is 2 (Capitalised), 5 (Depreciated), 6 (Expensed), 8 (Impaired), 10 (Split) or 12 (Disposed). |

| fiscal_year | numeric | Optional. Links to an entry on the ASSET_BOOK_PERIOD table. Required if event_type_id is 2 (Capitalised), 5 (Depreciated), 6 (Expensed), 8 (Impaired), 10 (Split) or 12 (Disposed). |

| fiscal_period | number | Optional. Links to an entry on the ASSET_BOOK_PERIOD table. Required if event_type_id is 2 (Capitalised), 5 (Depreciated), 6 (Expensed), 8 (Impaired), 10 (Split) or 12 (Disposed). |

| event_date_time | datetime | This is the date and time (timestamp) when the event occurred. |

| party_id_transacting | numeric | Optional. This identifies the party (person or organisation) which is a customer, vendor, contractor or employee. Links to an entry on the PARTY table. |

| event_type_id | numeric | This is the type of event which occurred, which may be one of the following:

|

| debit_fn | numeric | Optional. The amount in the functional currency of the party_id_functional. Never negative. Must be blank if credit_fn is greater than zero. |

| credit_fn | numeric | Optional. The amount in the functional currency of the party_id_functional. Never negative. Must be blank if debit_fn is greater than zero. |

| debit_tx | numeric | Optional. The amount in the asset currency. Never negative. Must be blank if credit_tx is greater than zero. |

| credit_tx | numeric | Optional. The amount in the asset currency. Never negative. Must be blank if debit_tx is greater than zero. |

| debit_discount_fn | numeric | Optional. The trade-in discount amount in the functional currency of the party_id_functional. Never negative. Must be blank if credit_discount_fn is greater than zero. |

| credit_discount_fn | numeric | Optional. The trade-in discount amount in the functional currency of the party_id_functional. Never negative. Must be blank if debit_discount_fn is greater than zero. |

| debit_discount_tx | numeric | Optional. The trade-in discount amount in the asset currency. Never negative. Must be blank if credit_discount_tx is greater than zero. |

| credit_discount_tx | numeric | Optional. The trade-in discount amount in the asset currency. Never negative. Must be blank if debit_discount_tx is greater than zero. |

| receipt_no | string | Optional. The official receipt number for asset disposal. Must always be blank unless the event_type_id is 12 (Disposed). |

| invoice_type | string | Optional. Links to an entry on the INVOICE_HEADER table. |

| invoice_id | numeric | Optional. Links to an entry on the INVOICE_HEADER table. |

| invoice_adjustment_seq_no | numeric | Optional. Links to an entry on the INVOICE_ADJUSTMENT table. |

| invoice_item_seq_no | numeric | Optional. Links to an entry on the INVOICE_ITEM table. |

| invoice_item_prod_feature_id | numeric | Optional. Links to an entry on the INVOICE_ITEM_FEATURE table. |

| invoice_item_adjustment_seq_no | numeric | Optional. Links to an entry on the INVOICE_ITEM_ADJUSTMENT table. |

| order_type | string | Optional. Links to an entry on the ORDER_HEADER table. |

| order_id | numeric | Optional. Links to an entry on the ORDER_HEADER table. |

| order_adjustment_seq_no | numeric | Optional. Links to an entry on the ORDER_ADJUSTMENT table. |

| order_item_seq_no | numeric | Optional. Links to an entry on the ORDER_ITEM table. |

| order_item_prod_feature_id | numeric | Optional. Links to an entry on the ORDER_ITEM_FEATURE table. |

| order_item_adjustment_seq_no | numeric | Optional. Links to an entry on the ORDER_ITEM_ADJUSTMENT table. |

| shipment_id | numeric | Optional. Links to an entry on the SHIPMENT table. |

| item_issuance_id | numeric | Optional. Links to an entry on the ITEM_ISSUANCE table. |

| lot_id | numeric | Optional. Links to an entry on the LOT_PRODUCT table. |

| product_id | string | Optional. Links to an entry on the LOT_PRODUCT and PRODUCT tables. |

| serial_no | string | Optional. This is the native serial number or vehicle identification number (VIN), if any, allocated by the manufacturer or owner of the asset. Maximum 17 characters for a VIN. |

| schedule_id | numeric | Optional. Links to an entry on the PM_SCHEDULE table. |

| activity_seq_no | numeric | Optional. Links to an entry on the PM_SCHEDULE table. |

| timesheet_id | numeric | Optional. Links to an entry on the TIMESHEET_ENTRY table. |

| work_effort_id | numeric | Optional. Links to an entry on the TIMESHEET_ENTRY table. |

| seq_no | numeric | Optional. Links to an entry on the TIMESHEET_ENTRY table. |

| day_no | numeric | Optional. Links to an entry on the TIMESHEET_ENTRY table. |

| expense_id | numeric | Optional. Links to an entry on the EXPENSE_ITEM table. |

| fault_type_id | string | Optional. Links to an entry on the FAULT_TYPE table. |

| note_text | string | Optional. This is freeform text describing the event. |

| is_posted | boolean | A YES/NO switch with an initial value of NO. It indicates if this event has been posted to the general ledger (YES) or not (NO).

All events will create general ledger journal entries, except those having the following event_type_id values:

|

This contains information about depreciation or amortisation taken for each for asset, vintage account or general asset account book, by fiscal year and period.

| Field | Type | Description |

|---|---|---|

| party_id_functional | numeric | Links to an entry on the ASSET_OWNER_BOOK and FUNCTIONAL_UNIT tables. |

| asset_book_type_id | string | Links to an entry on the ASSET_OWNER_BOOK table. |

| asset_owner_book_id | numeric | Links to an entry on the ASSET_OWNER_BOOK table. |

| fiscal_calendar_id | numeric | This identifies the fiscal calendar. Links to an entry on the FISCAL_CALENDAR_PERIOD table. Automatically determined by the system based on the party_id_functional. |

| fiscal_year | numeric | This identifies the Gregorian year when the end of the fiscal year occurs. Automatically calculated by the system based on the fiscal_period. Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| fiscal_period | numeric | This identifies the fiscal period. Links to an entry on the FISCAL_CALENDAR_PERIOD table. |

| depreciation_method_id | numeric | This is the method for depreciating or amortising the asset, vintage account or general asset account for this book. Links to an entry on the DEPRECIATION_METHOD table. |

| depreciation_fn | numeric | This is the depreciation or amortisation expense taken for the asset, vintage account or general asset account book during the fiscal_year and fiscal_period, denominated in the functional currency of the party_id_functional. |

| depreciation_addl_first_yr_fn | numeric | This is the additional first-year depreciation or amortisation expense taken for the asset, vintage account or general asset account book during the fiscal_year and fiscal_period, denominated in the functional currency of the party_id_functional. |

| expense_deduction_fn | numeric | This is the expense deduction (such as Section 179 expense in the U.S.) taken for the asset, vintage account or general asset account book during the fiscal_year and fiscal_period, denominated in the functional currency of the party_id_functional. |

| split_income_fn | numeric | This is income realised from splitting the asset, vintage account or general asset account book during the fiscal_year and fiscal_period, denominated in the functional currency of the party_id_functional. |

| disposition_income_fn | numeric | This is income realised from disposing of the asset, vintage account or general asset account book during the fiscal_year and fiscal_period, denominated in the functional currency of the party_id_functional. |

This holds information about the types of depreciation or amortisation books that can be maintained for assets, vintage accounts or general asset accounts.

| Field | Type | Description |

|---|---|---|

| asset_book_type_id | string | Unique identity assigned by the user. |

| asset_book_type_name | string | Short name |

| asset_book_type_desc | string | Optional. Long description. |

| affects_gl | boolean | A YES/NO switch with an initial value of YES. It indicates if depreciation or amortisation transactions recorded for asset, vintage account or general asset account books of this type will create general ledger journal entries.

Only one of the ASSET_BOOK_TYPE entries linked to a particular party_id_functional and asset_id, vintage_account_id or general_asset_account_id on the ASSET_OWNER_BOOK table may affect the general ledger. |

This contains information about the business entities which own each asset.

| Field | Type | Description |

|---|---|---|

| asset_id | numeric | Links to an entry on the ASSET table. |

| party_id_functional | numeric | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the FUNCTIONAL_UNIT table. |

| chart_id | numeric | Optional. Read only. This identifies the chart of accounts for the party_id_functional. Links to an entry on the GL_ACCOUNT table. |

| account_id_auc | string | Optional. This identifies the default general ledger asset account to be debited when value is added to an asset under construction (AUC) belonging to this general asset account. Links to an entry on the GL_ACCOUNT table. |

| account_id_ffe | string | Optional. This identifies the default general ledger asset account to be debited when an asset belonging to this general asset account is capitalised and placed into service. Links to an entry on the GL_ACCOUNT table. |

| account_id_accum_depreciation | string | Optional. This identifies the default general ledger contra asset account to be credited when this general asset account is depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_expense | string | Optional. This identifies the default general ledger expense account to be debited when an asset belonging to this general asset account is expensed instead of depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_depreciation | string | Optional. This identifies the default general ledger expense account to be debited when this general asset account is depreciated or amortised. Links to an entry on the GL_ACCOUNT table. |

| account_id_impairment | string | Optional. This identifies the default general ledger expense account to be debited when an asset belonging to this general asset account is impaired. Links to an entry on the GL_ACCOUNT table. |

| account_id_disposal | string | Optional. This identifies the default general ledger income account to be credited when an asset belonging to this general asset account is disposed of. Links to an entry on the GL_ACCOUNT table. |

| ownership_percent | numeric | This is the ownership share percentage. All entries must be greater than zero, and less than or equal to 100. The default value is 100. |

| business_use_percent | numeric | This is the business use percentage. All entries must be greater than zero, and less than or equal to 100. The default value is 100. |

| asset_cost_fn | numeric | This is the owner's share of the asset cost at the time it was placed into service and capitalised, denominated in the functional currency of the party_id_functional. This value cannot be modified after the asset is capitalised. |

| asset_cost_tx | numeric | This is the owner's share of the asset cost at the time it was placed into service and capitalised, denominated in the asset currency. This value cannot be modified after the asset is capitalised. |

| exchange_rate_type_id | string | Optional. This identifies the historical exchange rate type utilised by this owner for this asset when translating financial statements into reporting currency. Links to an entry on the EXCHANGE_RATE_TYPE table. |

| salvage_value_fn | numeric | This is the owner's share of the estimated salvage value of the asset at the time it was placed into service and capitalised, denominated in the functional currency of the party_id_functional. This value cannot be modified after the asset is capitalised. |

| salvage_value_tx | numeric | This is the owner's share of the estimated salvage value of the asset at the time it was placed into service and capitalised, denominated in the asset currency. This value cannot be modified after the asset is capitalised. |

| date_capitalised | date | Optional. This is the date when the asset was placed into service by the owner. May not be earlier than the date_construction_start of the asset. This value cannot be modified after the asset is capitalised. |

| useful_life_months | numeric | This is the useful life of the asset recognised by the owner, in Gregorian months. May not be less than zero (0). |

| date_retired | date | Optional. This is the date when the owner withdrew the asset from service, having reached the end of its useful life or become redundant. May not be earlier than the date_capitalised. |

| date_disposed | date | Optional. This is the date when the owner disposed of the asset. May not be earlier than the date_capitalised. |

This contains information about each of the depreciation or amortisation methods utilised by the business entities which own each asset, vintage account or general asset account.

| Field | Type | Description |

|---|---|---|

| party_id_functional | numeric | This identifies an organisation which is a functional unit for which a balanced set of books is kept in the GL_ACCOUNT_PERIOD_BALANCE table. Links to an entry on the FUNCTIONAL_UNIT table. |

| asset_book_type_id | string | Links to an entry on the ASSET_BOOK_TYPE table. Only one of the ASSET_BOOK_TYPE entries for a particular party_id_functional and asset_id, vintage_account_id or general_asset_account_id may have an affects_gl value of YES. |

| asset_owner_book_id | numeric | Unique number generated by the system, starting at 1 and incrementing by 1. |

| asset_id | numeric | Optional. Links to an entry on the ASSET table.

Required if vintage_account_id or general_asset_account_id are both blank. Must be blank if vintage_account_id or general_asset_account_id is not blank. |

| vintage_account_id | string | Optional. This is the vintage account in which the asset is grouped. Each vintage account comprises all assets of a particular class that were acquired during a particular tax year. Depreciation for a vintage account is computed as if the entire account were a single asset. Links to an entry on the VINTAGE_ACCOUNT table and the date_capitalised must fall on or between the tax_period_start_date and tax_period_end_date of that entry.

Required if asset_id and general_asset_account_id are both blank and in this case the chart_id of the vintage account must be the same as the chart_id of the party_id_functional. Must be blank if asset_id or general_asset_account_id is not blank. |

| general_asset_account_id | string | Optional. This is the general asset account in which the asset is grouped. Each general asset account comprises all assets of a particular class that were acquired during a particular tax year. Depreciation for a general asset account is computed as if the entire account were a single asset. Links to an entry on the GENERAL_ASSET_ACCOUNT table and the date_capitalised must fall on or between the tax_period_start_date and tax_period_end_date of that entry.

Required if asset_id and vintage_account_id are both blank and in this case the chart_id of the general asset account must be the same as the chart_id of the party_id_functional. Must be blank if asset_id or vintage_account_id is not blank. |

| depreciation_method_id | numeric | This is the method for depreciating or amortising the asset, vintage account or general asset account for this book. Links to an entry on the DEPRECIATION_METHOD table. |

| date_capitalised | date | Optional. This is the date when the asset, vintage account or general asset account was placed into service by the owner. This value cannot be modified after the asset, vintage account or general asset account is capitalised on this book. |

| asset_cost_fn | numeric | This is the owner's share of the acquisition or construction cost at the time the asset, vintage account or general asset account was placed into service and capitalised, denominated in the functional currency of the party_id_functional. This value cannot be modified after the asset is capitalised. |

| asset_cost_tx | numeric | This is the owner's share of the acquisition or construction cost at the time the asset, vintage account or general asset account was placed into service and capitalised, denominated in the asset currency. This value cannot be modified after the asset is capitalised. |

| exchange_rate_type_id | string | Optional. This identifies the historical exchange rate type utilised by this owner for this asset, vintage account or general asset account book when translating financial statements into reporting currency. Links to an entry on the EXCHANGE_RATE_TYPE table. |

| salvage_value_fn | numeric | This is the owner's share of the estimated salvage value of the book at the time the asset, vintage account or general asset account was placed into service and capitalised, denominated in the functional currency of the party_id_functional. This value cannot be modified after the asset is capitalised. |

| salvage_value_tx | numeric | This is the owner's share of the estimated salvage value of the book at the time the asset, vintage account or general asset account was placed into service and capitalised, denominated in the asset currency. This value cannot be modified after the asset is capitalised. |

| useful_life_months | numeric | This is the useful life of the asset, vintage account or general asset account book recognised by the owner, in Gregorian months. May not be less than zero (0). |

| accum_depreciation_fn | numeric | Read only. This is the accumulated depreciation or amortisation ever taken for the asset, vintage account or general asset account book, denominated in the functional currency of the party_id_functional. |

| expense_deduction_fn | numeric | Read only. This is the cumulative expense deduction (such as Section 179 expense in the U.S.) ever taken for the asset, vintage account or general asset account book, denominated in the functional currency of the party_id_functional. |

This holds information about the types of faults or breakdowns which may be recorded in the event history for an asset and its owners.

| Field | Type | Description |

|---|---|---|

| fault_type_id | string | Unique identity assigned by the user. |

| fault_type_name | string | Short name. |

| fault_type_desc | string | Optional. Long description. |

| criticality_type | string | This denotes the criticality or severity of the fault or breakdown, which may be one of the following:

|

Figure 13 - Links between ASSET table and other subsystems

| Subsystem | Table |

|---|---|

| Shipment | VEHICLE |

| Work Effort | WORK_EFFORT |

This information exists within a shared table in the MENU database and not a separate table within the FINANCE_FA database. It holds values which can be varied to suit that particular installation. The current values are as follows:

| Id | Description | Value (example) |

|---|---|---|

| IS_UPC_CO_PREFIX | Indicates if a GS1 U.P.C. Company Prefix must be derived from the Participant ID (1) or not (0). Always zero (0) if the number of digits in the Participant ID = 12; otherwise the default value is one (1). Note that the value must be one (1) if the Participant ID was assigned by Geoprise Technologies or is a D.U.N.S. number. |

Date created: 20th August 2020

| 30th Dec 2024 | Updated the ASSET table to rename the is_container_id column to inv_container_id. |

| 30th Mar 2024 | Updated the ASSET table to include the sector_id column. |

| 25th Apr 2023 | Updated the ASSET_BOOK_EVENT table to include the seq_no column. |

| 22nd Nov 2022 | Added the ASSET_EVENT table.

Amended the the Asset Lifecycle events section. |

Copyright © 1999-2025 by Geoprise Technologies Licensing, All Rights Reserved.